American Express Org Chart & Sales Intelligence blog

American Express

200 Vesey Street

New York, NY 10285

United States

Main Phone: (212) 640-2000

Website URL: www.americanexpress.com

Fortune 500 rank: #67 (2020)

Ticker Symbol: (NYSE: AXP)

Industry Sector: Financial Services, Credit

American Express Blog Highlights

American Express Company (NYSE: AXP) is ranked #67 on the 2020 Fortune 500 list

- The company continues to introduce a range of new B2B payment solutions for businesses of all sizes, including the recent launch of American Express One AP for middle-market companies

- The People’s Bank of China officially accepted American Express’ network application, which was an important next step in American Express' plan to build a network business in China.

American Express Social Media properties

Facebook: https://www.facebook.com/AmericanExpressUS

Instagram: https://www.instagram.com/AmericanExpress/

LinkedIn: https://www.linkedin.com/company/american-express/

Twitter: https://twitter.com/askamex

YouTube: https://www.youtube.com/user/AmericanExpress

American Express Sales Trigger Events

Federal Investigators Probing AmEx Card Sales Practices

January 7, 2021

The inspectors general offices of the Treasury Department, Federal Deposit Insurance Corp. and Federal Reserve are investigating whether AmEx used aggressive and misleading sales tactics to sell cards to business owners and whether customers were harmed, the people said. They are also examining whether specific employees contributed to the alleged behavior and if higher-level employees supported it, some of the people said.

More than a dozen current and former AmEx employees previously told The Wall Street Journal that some salespeople strong-armed or misled small-business owners into signing up for cards to boost sales numbers. Some salespeople misrepresented card rewards and fees, or issued cards that customers hadn’t sought, they said.

Source

American Express Enhances Early Pay Supply Chain Solution for Large Companies

Nov 16, 2020

American Express (NYSE:AXP) announced enhancements to Early Pay in the U.S., the company’s supply chain payment solution to give large companies1 - and their suppliers - the ability to pay and get paid when they want through an easy-to-use digital platform. Initially launched in 2018, American Express’ Early Pay solution has evolved to provide important benefits to both buyers and suppliers. It helps buyers have greater control of their accounts payable process for their B2B payments, generate extra cash from early payment discounts and finance their payments should they need the working capital.

“As we continue to focus on enabling digital payments beyond our traditional Corporate Cards, we are investing in solutions to improve the buyer and supplier experience and help solve common B2B payment-related pain points,” said Daniel Brachfeld, Vice President/General Manager, Supply Chain Solutions at American Express. “Right now, businesses are more focused on digital transformation than ever before, with 84% of U.S. business decision makers saying they feel positive about transitioning to a digital payments system..."

Source

American Express Names Colleen Taylor, President, Merchant Services

Sep 10, 2020

U.S.American Express (NYSE: AXP) announced that Colleen Taylor will join the company on September 14 as President, Merchant Services – U.S. Taylor will report to Anré Williams, Group President, Global Merchant & Network Services, and be a member of his Leadership Team. In this newly created role, Taylor will lead the organization that acquires and manages the relationships with the millions of merchants that accept American Express across the U.S.Taylor joins American Express from Wells Fargo where she served as EVP, Merchant Services, providing the strategic direction, financial management, and leadership of Wells Fargo’s Merchant Services business. Prior to this, she served as EVP, New Payments at Mastercard where she oversaw product development and drove growth across North America in key industries such as B2B, Government, and emerging payments. She also held leadership positions at Capital One, including head of Treasury Management, Merchant Services and Enterprise Payments, as well as at Wachovia Bank and JPMorgan Chase.

Source

POWER PLAYERS: Meet 11 American Express execs leading the card giant's digital payments and small-business lending push

Aug 11, 2020

The adoption of digital payments has taken off amid the coronavirus pandemic, as consumers look to avoid cash. American Express, both a card network and credit issuer, is riding the digital wave with products like contactless cards, partnerships with players like Venmo, and QR codes to pay. And now, the card giant is eyeing an acquisition of small business lender Kabbage, according to Bloomberg.

From fraud monitoring to credit decisioning to exploring new ways to pay, here are the 11 power players leading Amex's digital push.

- Raff Breaks, senior vice president of enterprise digital member experiences

- Gina Taylor Cotter, senior vice president and general manager of global business financing

- Danielle Crop, senior vice president and chief data officer

- Tina Eide, senior vice president of global fraud and credit bust out (CBO) risk management

- Luke Gebb, senior vice president of Amex Digital Labs

- Priscilla Kam, senior vice president of global strategy & capabilities

- Ben Leventhal, CEO of Resy, part of the American Express Global Dining Network

- Stacy Poritzky, vice president of partnership marketing and global consumer services group

- Erich Ringewald, senior vice president and chief technology architect

- Harshul Sanghi, senior vice president and global head of Amex Ventures

- Chao Yuan, senior vice president and head of decision science & data strategy

Source

How American Express is tapping the benefits of hybrid cloud

Jul 13, 2020

Evan Kotsovinos is no stranger to that reality. As head of global infrastructure for American Express (Amex), one of his responsibilities includes overseeing cloud strategy for the globally-integrated payments company, which serves more than 100 million card members around the world. Kotsovinos also manages the firm’s technology response to the COVID-19 pandemic.

Kotsovinos discusses why cloud adoption is all about maximizing business outcomes. He shares a misnomer he still frequently hears from peers about the cloud (hint: it has to do with pricing), and he explains why infrastructure teams and leaders should consider themselves curators.

Source

CIO Interview: Amex Global Business Travel CTO on incident response

Jul 1, 2020

Like many global firms, American Express Global Business Travel (Amex GBT) needed to adapt its IT department overnight after the industry was brought to a rapid standstill by the coronavirus outbreak.

David Thompson, chief technology officer (CTO) for products and technology at Amex GBT, says the company began seeing lockdowns appear in late January, and the company kicked emergency response measures into gear to support clients and protect its staff.

Thompson says the incident response strategy aims to respond to client needs and keep American Express GBT’s own employees safe. “We have a pretty mature incident response and made an early decision to close offices,” he says. “If our people were travelling, we made provisions to get them back home. We leverage our data to determine where our people are located, their access online and whether they are working remotely or at an office.”

Source

Would you like to see dozens more hand-curated sales trigger events, articles, case studies, success stories, executive interviews, and more? Please download the Amex Deep Dive Sales Intelligence Report.

American Express Earnings Call Highlights

American Express (NYSE:AXP) Q3 2020 Earnings Call

October 23, 2020

Executives in Attendance

Vivian Zhou - Head of Investor Relations

- Steve Squeri - Chairman and Chief Executive Officer

- Jeff Campbell - Chief Financial Officer

Analysts in Attendance

- Don Fandetti -- Wells Fargo Securities -- Analyst

- Betsy Graseck -- Morgan Stanley -- Analyst

- David Togut -- Evercore ISI -- Analyst

- Bill Carcache -- Wolfe Research - Analyst

- Rick Shane -- J.P. Morgan - Analyst

- Bob Napoli -- William Blair - Analyst

- Jamie Friedman -- Susquehanna International Group - Analyst

- Mark DeVries -- Barclays - Analyst

- Meng Jiao -- Deutsche Bank - Analyst

- Craig Maurer -- Autonomous Research - Analyst

- Sanjay Sakhrani -- KBW - Analyst

Comments from Steve Squeri, Chairman & CEO

"While our results continue to be significantly affected by the impacts of the pandemic, we're increasingly confident that our strategy for managing through the current environment is the right one."

"non-T&E spending in the quarter, which has long accounted for the large majority of our volumes, was up slightly year over year."

"Online consumer retail spending was particularly strong, up 32% over last year. And within our commercial business, AP automation volumes continued their rapid growth, although from a small base, doubling since last year's third quarter as more businesses adopt digital payment solutions."

"We continue to invest in our business by launching our largest-ever Shop Small initiative, supporting small merchants in 18 markets around the world."

"we've begun to selectively increase customer acquisition activities across our businesses."

"four key priorities for 2020, which I'll remind you include:

- supporting our colleagues and winning as a team,

- protecting our customers and the brand,

- structuring the company for growth and

- remaining financially strong."

"As conditions begin to improve in a number of countries since moving virtually all of our 64,000 colleagues to work-from-home arrangements in March, we have begun the phased reopening of our offices in 25 of our locations, including our headquarters in New York"

"Our customers have recognized our commitment to service excellence, ranking us No.1 in the J.D. Power 2020 U.S. Credit Card Satisfaction Study, the 10th time we've achieved the top spot."

"Our last priority is structuring the company for growth. We continue to selectively invest for the long term."

"our recent acquisition of Kabbage, a leading financial technology company serving small businesses in the U.S., and in the official launch of our network in Mainland China, where in addition to signing merchants and cementing relationships with key digital partners, WeChat and Alipay, we're currently working to develop debit capabilities on our network to capture some of the significant debit usage within China."

"We've been looking at our strategy for managing through this cycle through the lens of three phases. The first phase has been about navigating through the peak of the crisis, and we've been focused on this phase the past few quarters. The second phase, which we are now in the early stages of, is about rebuilding our growth momentum by increasing investments in key strategic areas. Our goal in doing this is to enable us to enter the third phase, generating pre-COVID levels of earnings and returning to our financial growth algorithm."

"Key areas of investment will include: accelerating customer acquisition activities across our businesses; continuing to refresh value propositions on our card products, including new, broader lifestyle benefits and additional business-centric offerings; developing additional solutions beyond the card to expand our relationships with small businesses; maintaining virtual parity coverage in the U.S. and expanding merchant coverage in key international markets while strengthening and broadening critical partnerships and enhancing our digital capabilities across our business."

Comments from Jeff Campbell, CFO

"The key drivers of our financial performance in this environment remain volume and credit trends"

"our results, obviously, continue to be significantly impacted by the global pandemic and the resulting containment measures that governments are taking around the world."

"Our proprietary business, which makes up 86% of our total billings, drives most of our financial results, it was down the same 20%."

"In the commercial segment, spending from small and medium-sized enterprise customers, which historically has the highest mix of non-T&E spending, has been the most resilient so far. Whereas large and global corporate card spending, which historically has been primarily T&E, has been down the most during the pandemic."

"overall, we see the consumers and SMEs, in particular, have adapted their behaviors to the challenges of the current environment, which is why non-T&E spending has recovered to pre-COVID levels and is starting to show some growth"

"We're continuing to break out our expenses between variable customer engagement expenses, which come down naturally as spend declines and benefits uses changes and marketing and opex, which are driven by management decisions."

"Variable customer engagement expenses in total were down 27% year over year, driven by lower spend and lower usage of travel-related benefits. The year-over-year decline in variable customer engagement expenses provided a 50% offset to the revenue decline in the third quarter."

"In contrast to the declines in variable customer engagement expenses, marketing expenses were up 23% year on year. This aligns with Steve's earlier point that we have entered the second phase of our strategy for managing through this cycle, which is about rebuilding growth momentum."

Source

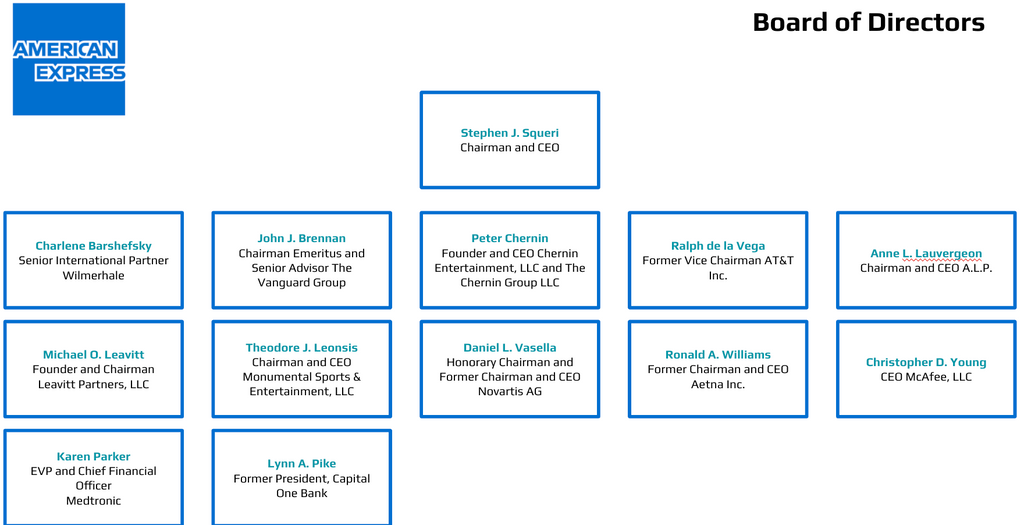

American Express Board of Directors

| NAME | TITLE | COMPANY |

| Stephen J. Squeri | Chairman and CEO | American Express |

| Charlene Barshefsky | Senior International Partner | Wilmerhale |

| John J. Brennan | Chairman Emeritus and Senior Advisor | The Vanguard Group, Inc. |

| Peter Chernin | Founder and CEO | Chernin Entertainment, LLC |

| Ralph de la Vega | Former Vice Chairman | AT&T Inc. |

| Anne Lauvergeon | Chairman and CEO | A.L.P. |

| Michael O. Leavitt | Founder and Chairman | Leavitt Partners, LLC |

| Theodore J. Leonsis | Chairman and CEO | Monumental Sports & Entertainment, LLC |

| Karen L. Parkhill | Executive Vice President and CFO | Medtronic |

| Charles Phillips | Former Chairman and CEO of Infor, Inc. | Infor, Inc. |

| Lynn A. Pike | Former President | Capital One Bank |

| Daniel L. Vasella | Honorary Chairman and Former Chairman and CEO | Novartis AG |

| Ronald A. Williams | Former Chairman and CEO | Aetna, Inc. |

| Christopher D. Young | CEO | McAfee, LLC |

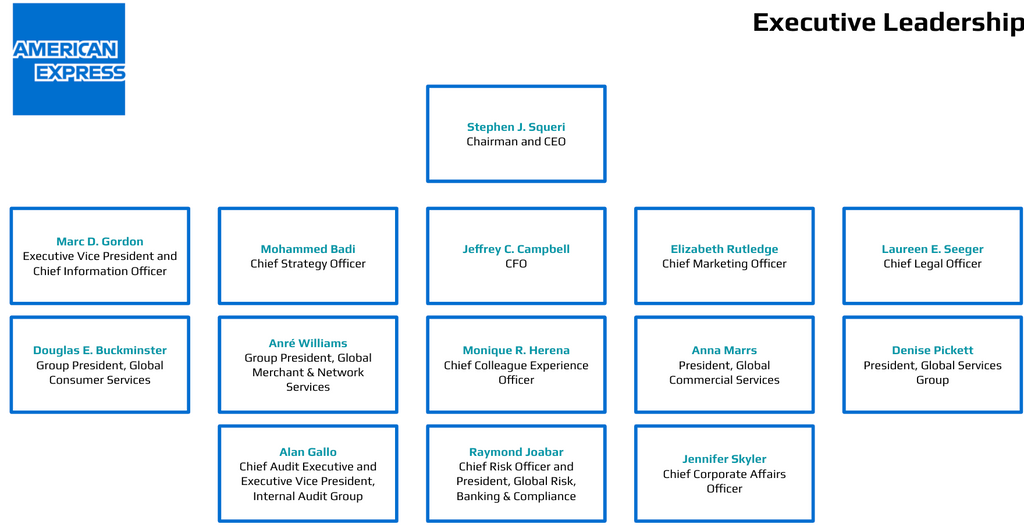

American Express Executive Committee

| Alan Gallo | Executive Vice President, Chief Audit Executive Internal Audit Group | American Express |

| Anna Marrs | President, Global Commercial Services | American Express |

| Anré Williams | Group President, Global Merchant & Network Services | American Express |

| Denise Pickett | President, Global Services Group | American Express |

| Doug Buckminster | Group President, Global Consumer Services | American Express |

| Elizabeth Rutledge | Chief Marketing Officer | American Express |

| Glenda McNeal | President, Enterprise Strategic Partnerships | American Express |

| J. Andres Espinosa | Chief Credit Officer and Executive Vice President, Credit and Fraud Risk | American Express |

| Jeff Campbell | Chief Financial Officer | American Express |

| Jennifer Skyler | Chief Corporate Affairs Officer | American Express |

| Laureen E. Seeger | Chief Legal Officer | American Express |

| Marc Gordon | Executive Vice President And Chief Information Officer | American Express |

| Mohammed Badi, PhD | Chief Strategy Officer | American Express |

| Monique R. Herena | Chief Colleague Experience Officer | American Express |

| Pierric Beckert | President, Global Network Services | American Express |

| Raymond Joabar | President and Chief Risk Officer, Global Risk and Compliance | American Express |

| Rick Petrino | Chief Operating Officer, American Express National Bank | American Express |

| Stephen J. Squeri | Chairman And Chief Executive Officer | American Express |

American Express Annual Report Highlights

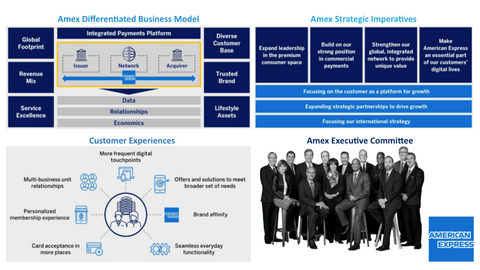

American Express' strategy of investing in share, scale, and relevance is working:

- Revenue reached a record $43.6 billion, and the fourth quarter of 2019 marked the 10th straight quarter of FX adjusted revenue growth at or above 8 percent.

- Growth was driven by a well-balanced mix of fee income, Card Member spending, and lending growth, with the subscription-like card fee revenue becoming the company's fastest growing revenue line.

- Worldwide spending surpassed $1.2 trillion, up 5 percent from the prior year.

- American Express achieved the company's goal of virtual parity merchant acceptance in the U.S. as of year end, an ambitious goal set in 2016. And the company remained committed to continuing expanding merchant acceptance globally.

American Express Financial Highlights

| Fiscal Year | |

| Fiscal Year Ends | December 31, 2020 |

| Most Recent Quarter | July 24, 2020 |

| Profitability | |

| Profit Margin | 11.89% |

| Operating Margin | 16.04% |

| Management Effectiveness | |

| Return on Assets | 2.11% |

| Return on Equity | 18.45% |

| Income Statement | |

| Revenue | $34.26 Billion |

| Revenue Per Share | 42.17 |

| Quarterly Revenue Growth | -38.70% |

| Gross Profit | 27.32B |

| EBITDA | N/A |

| Net Income Avi to Common | 3.96B |

| Diluted EPS | 4.86 |

| Quarterly Earnings Growth | -85.40% |

| Balance Sheet | |

| Total Cash | 41.7B |

| Total Cash Per Share | 51.79 |

| Total Debt | 50.55B |

| Total Debt/Equity | 239.99 |

| Current Ratio | 1.57 |

| Book Value Per Share | 26.16 |

| Cash Flow Statement | |

| Operating Cash Flow | 2.07B |

| Levered Free Cash Flow | N/A |

American Express Digital Engagement

By leveraging the unique assets of the company's integrated payments platform, American Express continue to bring American Express membership to life in our digital channels in ways that are driving increased engagement with customers. The company have been hard at work integrating the acquisitions American Express made over the last few years, including the company latest additions of Resy® and LoungeBuddy®, to provide Card Members with premium access and experiences across a wide range of travel, dining and lifestyle services that differentiate the company from competitors.

The company is also working with partners and internal development teams to deepen relationships with current customers, attract news ones and harness the power of new online and mobile capabilities. A couple examples include “split-the-bill” feature, which American Express developed with partner PayPal, on the new U.S. Green Card, and home- grown offerings such as Early Pay financing solution to help business customers capture discounts and manage their cash flow. On the dining front, American Express are integrating a reservation booking feature in the American Express® Mobile App for searching, booking and managing restaurant reservations at more than 10,000 restaurants globally. The tool is currently available to select Platinum Card Members and will be rolling out to Platinum and Centurion Card Members in the first half of 2020.

These launches demonstrate the company's commitment to provide digital-first Membership benefits to Card Members and back merchants big and small so that American Express becomes an indispensable part of their lives. American Express seeing good results, as customer engagement with digital channels is strong and growing. In 2019, 81 percent of active Card Members digitally engaged with the company through the American Express mobile app.

American Express' Expanding Network

Relationship with millions of merchants around the world is a key component of the integrated payments platform, and consistently expanding the number of places where American Express Cards are accepted continues to be one of American Express' top priorities.

In 2019, American Express made great strides in expanding merchant network in the U.S. and internationally. First, in the U.S., American Express achieved virtual parity merchant acceptance, with approximately 99 percent of credit card-accepting merchants in the U.S. now able to accept American Express. Achieving this ambitious goal is key to American Express' overall business strategy, as expanding merchant coverage drives Card Member and partner satisfaction while also increasing spend on the network.

The work on this front will not stop. The merchant landscape is dynamic, with hundreds of thousands of U.S. businesses opening and closing ever year. The company will continue to focus on maintaining virtual parity coverage in the U.S. going forward.

The company also made good progress increasing merchant coverage in international markets where Card Members live, work and travel to the most, adding more than 2 million merchant locations in 2019. This remains a focus for the company in 2020. Going forward, as American Express continues to grow network, the company will work with merchant partners in the U.S. and around the world to ensure that Card Members are warmly welcomed and encouraged to spend in the millions of places where their

In another milestone, the People’s Bank of China officially accepted American Express’ network application, which was an important next step in American Express' plan to build a network business in China.

See the Full American Express Annual Report

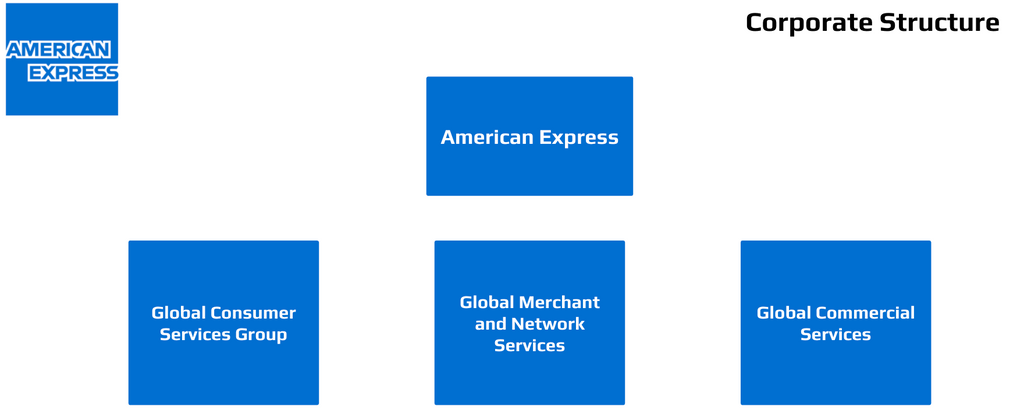

American Express Org Charts

More on American Express

- American Express Contact Info

- American Express Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology, R&D, Manufacturing, etc.

- American Express Financial Insights

- American Express SWOT Report

- American Express Technologies in Use

- American Express IT Budgets

- American Express Social Media Profiles

- American Express Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com