Capital One Org Chart & Sales Intelligence Blog

Capital One

1680 Capital One Drive

McLean, VA 22102

United States

Main Phone: (703) 720-1000

Website: http://www.capitalone.com

Sector(s): Financial Services

Industry: Credit Services

Full-Time Employees: 53,100

Capital One Blog Highlights

Capital One Financial Corporation (NYSE: COF) is ranked #97 on the 2020 Fortune 500 list

- Capital One cuts credit limits as millions struggle with income cliff

- Capital One Acquires Freebird’s Flight Disruption Tech

- Capital One fined $80M by regulators over 2019 data breach, agrees to improvements

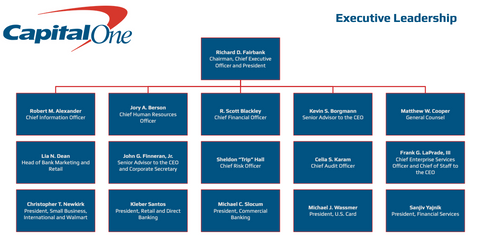

Capital One Org Charts

Capital One Social Media properties

Facebook: https://www.facebook.com/capitalone/

Instagram: https://www.instagram.com/capitalone/

LinkedIn: https://www.linkedin.com/company/capital-one/

Twitter: https://twitter.com/capitalone

YouTube: https://www.youtube.com/user/capitalone/

Capital One Earnings Call Highlights

July 21, 2020

Executives In Attendance

- Jeff Norris - Senior Vice President of Global Finance

- Richard Fairbank - Chairman and Chief Executive Officer

- Scott Blackley - Chief Financial Officer

Analysts in Attendance

- Betsy Graseck - Morgan Stanley

- Ryan Nash - Goldman Sachs

- Rick Shane - J.P. Morgan

- Sanjay Sakhrani - KBW

- Don Fandetti - Wells Fargo

- Eric Wasserstrom - UBS

- Moshe Orenbuch - Credit Suisse

- John Hecht - Jefferies

- Bob Napoli - William Blair

- Domestic card ending loan balances shrink by $3.6 billion or 3% year-over-year, while average loans declined 1%. Excluding the impact of the Walmart portfolio acquisition, ending loans shrink by around 10% year-over-year while average loans were down about 8%.

- Revenue decreased 7% year-over-year. Revenue declined more than average loans as revenue margin decreased 105 basis points compared to the second quarter of 2019. The majority of the revenue margin decrease was driven by the expected impact of the revenue sharing agreement on the acquired Walmart portfolio and the revenue benefit in the second quarter of last year from the company's choice to exit several small partnerships. Lower net interchange revenue also contributed to the revenue margin decline.

- Non-interest expense was down $258 million from the second quarter of last year, largely driven by choice to pull back on marketing. Provision for credit losses was up by $1.9 billion year-over-year as a result of the large COVID driven allowance build. Second-quarter credit results were strikingly strong, especially in the context of the pandemic. The charge-off rate for the quarter was 4.53%, a 33 basis point improvement year-over-year. The 30 plus delinquency rate at quarter end was 2.74%, a 66 basis point improvement from the prior year.

- Several factors likely drove the striking improvement. Credit performance is benefiting from resilience choices Capital One made before the downturn began. Consumers are behaving cautiously and paying down debt. Government stimulus is dramatically altering the normal relationship between the unemployment rate and consumer credit, at least in the short term. And widespread forbearance across the banking industry is helping consumers manage through financial stress.

Capital One Q2 Earnings Call on July 21, 2020

Capital One Board of Directors

| NAME | TITLE | COMPANY |

| Richard D. Fairbank | Chairman, CEO and President | Capital One Financial Corp. |

| Aparna Chennapragada | Vice President, Augmented Reality | |

| Ann Fritz Hackett | Partner and Co-Founder | Personal Pathways, LLC |

| Peter Thomas Killalea | Owner and President, Aoinle, LLC; Former VP of Technology | Amazon.com |

| Cornelis Petrus Adrianus Joseph "Eli" Leenaars | Vice Chairman of the Global Wealth Management Division | UBS Group AG |

| Pierre E. Leroy | Managing Partner | Aspiture, LLC |

| François Locoh-Donou | President, CEO and Director | F5 Networks, Inc. |

| Peter E. Raskind | Former Chairman, President and CEO | National City Corporation |

| Eileen Serra | Former Senior Advisor, Former CEO, Chase Card Services | JP Morgan Chase & Co |

| Mayo A. Shattuck III | Chairman, Exelon Corp. Former Chairman, President and CEO | Constellation Energy Group |

| Bradford H. Warner | Former President of Premier and Small Business Banking | Bank of America Corp. |

| Catherine G. West | Former Special Advisor, Promontory Financial Group; Former Associate Director and Chief Operating Officer, | Consumer Financial Protection Bureau |

Capital One Annual Report Highlights

Capital One 2019 Annual Report filed for Fiscal Year-End December 31, 2020

Capital One Financial Corporation, a Delaware corporation established in 1994 and headquartered in McLean, Virginia, is a diversified financial services holding company with banking and non-banking subsidiaries. Capital One Financial Corporation and its subsidiaries (the “Company” or “Capital One”) offer a broad array of financial products and services to consumers, small businesses and commercial clients through digital channels, branches, Cafés and other distribution channels.

As of December 31, 2019, Capital One principal subsidiaries included:

- Capital One Bank (USA), National Association (“COBNA”), which offers credit and debit card products, other lending products and deposit products; and

- Capital One, National Association (“CONA”), which offers a broad spectrum of banking products and financial services to consumers, small businesses and commercial clients.

Capital One Financial Highlights

| Fiscal Year | |

| Fiscal Year Ends | December 31, 2019 |

| Most Recent Quarter | June 30, 2020 |

| Profitability | |

| Profit Margin | 1.64% |

| Operating Margin | 1.17% |

| Management Effectiveness | |

| Return on Assets | 0.06% |

| Return on Equity | 0.45% |

| Income Statement | |

| Revenue | $15.32 Billion |

| Revenue Per Share | 33.23 |

| Quarterly Revenue Growth | -60.00% |

| Gross Profit | 22.36B |

| EBITDA | N/A |

| Net Income Avi to Common | -119M |

| Diluted EPS | -0.26 |

| Quarterly Earnings Growth | N/A |

| Balance Sheet | |

| Total Cash | 58.43B |

| Total Cash Per Share | 127.95 |

| Total Debt | 46.36B |

| Total Debt/Equity | N/A |

| Current Ratio | N/A |

| Book Value Per Share | 111.4 |

| Cash Flow Statement | |

| Operating Cash Flow | 16.75B |

| Levered Free Cash Flow | N/A |

Capital One Business Developments

Capital One regularly explores and evaluates opportunities to acquire financial services and products as well as financial assets, including credit card and other loan portfolios, and enter into strategic partnerships as part of the company's growth strategy. Capital One also explore opportunities to acquire technology companies and related assets to improve our information technology infrastructure and to deliver on Capital One's digital strategy.

On September 24, 2019, Capital One launched a new credit card issuance program with Walmart Inc. (“Walmart”) and are now the exclusive issuer of Walmart’s cobrand and private label credit card program in the U.S. On October 11, 2019, the company's completed the acquisition of the existing portfolio of Walmart’s cobrand and private label credit card receivables (“Walmart acquisition”). As of the acquisition date, Capital One added approximately $8.1 billion to the company's domestic credit card loans held for investment portfolio.

In the second quarter of 2019, Capital One made the decision to exit several small partnership portfolios in the company's Credit Card business. Capital One sold approximately $900 million of receivables and transferred approximately $100 million to loans held for sale as of June 30, 2019, which resulted in a gain on sale of $49 million recognized in other non-interest income and an allowance release of $68 million.

Capital One Technology/Systems

Capital One leverages information and technology to achieve the company's business objectives and to develop and deliver products and services that satisfy our customers’ needs. A key part of the company's strategic focus is the development and use of efficient, flexible computer and operational systems, such as cloud technology, to support complex marketing and account management strategies, the servicing of customers, and the development of new and diversified products.

As part of the company's continuous efforts to review and improve technologies, Capital One continues to rely on third-party outsourcers to help deliver systems and operational infrastructure. These relationships include (but are not limited to): Amazon Web Services, Inc. (“AWS”) for the company's cloud infrastructure, Total System Services LLC (“TSYS”) for consumer and commercial credit card processing services for North American and U.K. portfolios, Fidelity Information Services (“FIS”) for certain of banking systems and International Business Machines Corporation for mainframe managed services.

Capital One Sales Trigger Events

Capital One explains how it's spent almost a decade modernizing its IT with Amazon's cloud and the agile developer methodology to move faster and stay competitive

September 2020

About a decade ago, give or take, Capital One started to revamp its technology to better reflect how the bank's customers now mostly interact with its services online. To get there, Capital One has left its own data centers behind and gone all-in on Amazon Web Services, the retailer's market-dominating cloud computing platform, even as its developer teams turn their attention to IT automation and DevOps — two industry trends that can help companies release more software, faster.

Source

Capital One fine is latest wake-up call for banks using the cloud

August 2020

The $80 million penalty assessed by the Office of the Comptroller of the Currency on Thursday against the McLean, Va., company for its security lapse highlights how serious a regulatory risk data-integrity issues are — especially those involving cloud computing. Thompson gained access to the Capital One data through an insecure web application firewall. Jim Reavis, co-founder and chief executive of the Cloud Security Alliance, said Capital One used open-source software to build its firewall to the servers.

Source

Capital One Acquires Freebird’s Flight Disruption Tech

August 2020

Banking giant Capital One acquired Freebird, a business-to-business startup whose predictive technology enables agents to sell smarter flight insurance and rebooking services, according to Freebird founder and CEO Ethan Bernstein on Wednesday. Freebird had stopped offering its service to the public. It had let travelers facing a canceled or delayed flight or missed connection to skip the line and quickly book a new ticket on any airline at no extra cost.

Source

Digital Transformation: Capital One to Close 37 Physical Bank Locations to Keep Up with Changing Consumer Behavior

March 2020

Capital One Financial Corporation (COF), a major US-based bank holding company focused on offering credit cards, auto loans, banking, and savings accounts, is preparing to close down 37 of its physical branch locations across the country. Derek Conrad, a Capital One representative, revealed that the bank’s clients are “increasingly engaging with us digitally.” Conrad added “We continue to see steady growth in mobile banking, online banking, enhanced ATMs, remote deposit capture, etc., however, we know that many customers still value some physical presence to provide assurance, advice, and the ability to facilitate and support some transactions.”

Source

Capital One to Shut Down Its Last Three Data Centers Next Year

2019

Pushing against the hybrid-cloud narrative, the bank is ‘all-in on public cloud.’

In 2020, Capital One will mark the final phase of its shift to the cloud by shutting down its last three data centers, George Brady, who leads the banking giant’s tech strategy, told Data Center Knowledge. “We are completely all-in on the public cloud, and we’ll exit the last of our data centers next year,” said Brady.

Source

Is AWS Liable in Capital One Breach?

Amazon is at least partly blame for the massive 2019 Capital One breach that impacted more than 100 million customers, senators are alleging. Security researchers however are of two minds. In a letter to the Federal Trade Commission (FTC), U.S. senators Ron Wyden (D-Ore.) and Elizabeth Warren (D-Mass.) called for the investigation of Amazon’s role in the Capital One data breach, where a hacker accessed data that was hosted on servers on Amazon’s cloud-based computing platform, Amazon Web Services (AWS).

Source

Would you like to see dozens more sales trigger events and actionable insights on Capital One? Please download the Capital One Deep Dive Account Intelligence Report.

Would you like to see dozens more detailed Capital One Org Charts? Please download the Capital One Deep Dive Account Intelligence Report

More on Capital One

- Capital One Contact Info

- Capital One Org charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology, R&D, Manufacturing, etc.

- Capital One Financial Insights

- Capital One SWOT Report

- Capital One Technologies in Use

- Capital One IT Budgets

- Capital One Social Media Profiles

- Capital One Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com