Caterpillar Org Chart & Sales Intelligence Blog

Caterpillar

510 Lake Cook Road

Suite 100

Deerfield, IL 60015

United States

Main Phone: (224) 551-4000

Website: http://www.caterpillar.com

Caterpillar Org Chart Blog Highlights

Caterpillar Inc. (NYSE: CAT) is ranked #62 on the 2020 Fortune 500 list

- Services Growth is at the Heart of Caterpillar's Strategy

- Caterpillar is enhancing digital capabilities and expanded digital offerings.

- Second-quarter sales and revenues of $10 billion decreased by 31%.

- APAC region was a bright spot

- Mining customers indicate that greenfield and brownfield projects are still moving forward

- Caterpillar invested approximately $3.5 billion in research and development (R&D) during the past two years

Caterpillar Org Charts

Caterpillar on Social Media

Instagram: https://www.instagram.com/caterpillarinc/

Facebook: https://www.facebook.com/caterpillarinc

LinkedIn: https://www.linkedin.com/company/caterpillar-inc/

Twitter: https://twitter.com/CaterpillarInc

YouTube: https://www.youtube.com/caterpillarinc/

Latest Caterpillar Q2 2020 Earnings Call Highlights

July 31, 2020

Executives In Attendance

- Jennifer Driscoll - Director, Investor Relations

- Jim Umpleby - Chairman and Chief Executive Officer

- Andrew Bonfield - Chief Financial Officer

Analysts in Attendance

- Ross Gilardi - Bank of America

- Jerry Revich - Goldman Sachs

- Ann Duignan - JP Morgan

- David Raso - Evercore ISI

- Andrew Casey - Wells Fargo Securities

- Jamie Cook - Credit Suisse

- Rob Wertheimer - Melius Research

- Nicole DeBlase - Deutsche Bank

- Mircea Dobre - Baird

- Steven Fisher - UBS

- Second-quarter sales and revenues of $10 billion decreased by 31%. The decline was mainly due to lower sales volume driven primarily by lower end user demand and changes in dealer inventories. Caterpillar reported sales to users decreased by 22% in the second quarter that was less of a drop than originally anticipated. Machine sales to users including construction industries and resource industries decreased by 23% driven by a 40% decline in North America.

- Asia-Pacific was a bright spot. The 7% increase in end-user demand for machines in Asia-Pacific was led by improved demand from China. Energy and transportation sales to users decreased by 18% as transportation and industrial were soft while reciprocating engines for oil and gas continue to decline as expected. Power generation remains steady with a year ago quarter.

- In addition, earlier this year some mining customers shut down operations relating to the COVID-19 pandemic. However, activity in May and June started to improve. Globally the average age of the large mining trucks fleet is historically high and in addition, customer interest and autonomy remains strong which Caterpillar believes represents a competitive advantage for Caterpillar. Conversations with mining customers indicate that greenfield and brownfield projects are still moving forward.

- During Caterpillar's last earnings call, Caterpillar reviewed strategy which focuses on services, expanded offerings and operational excellence. Caterpillar also discussed that the impact of COVID-19 in business had been more severe and chaotic than any cyclical downturn previously had envisioned. Importantly, while taken actions to reduce costs made a conscious decision to continue to invest in enablers of services growth including enhancing digital capabilities and expanded offerings; key elements of strategy for long-term profitable growth. While Caterpillar expects margins in 2020 to be better than a historical performance at a similar level of sales Caterpillar continues to believe it will be challenging to achieve the margin targets communicated during Caterpillar's 2019 investor day.

Caterpillar Q2 Earnings Call on July 31, 2020

Caterpillar Annual Report Highlights

Caterpillar 2019 Annual Report filed for Fiscal Year-End December 31, 2019

| NAME | TITLE | COMPANY |

| D. James Umpleby III | Chairman of the Board, CEO | Caterpillar Inc. |

| Kelly A. Ayotte | Former U.S. Senator representing New Hampshire | |

| David L. Calhoun | President and CEO | Boeing |

| Daniel M. Dickinson | Managing Partner | HCI Equity Partners |

| Juan Gallardo | Chairman of Organización | CULTIBA, S.A.B. de C.V. |

| William A. Osborn | Retired Chairman and CEO | Northern Trust Corp. and The Northern Trust Company |

| Debra L. Reed | Retired Chairman and CEO | Sempra Energy |

| Edward B. Rust, Jr. | Retired Chairman and CEO | State Farm Mutual Automobile Insurance Company |

| Susan C. Schwab | Professor, Univ. of Maryland School of Public Policy. Strategic Advisor | Mayer Brown LLP |

| Miles D. White | Executive Chairman of the Board | Abbott Laboratories |

| Rayford Wilkins, Jr. | Retired CEO of Diversified Businesses | AT&T Inc |

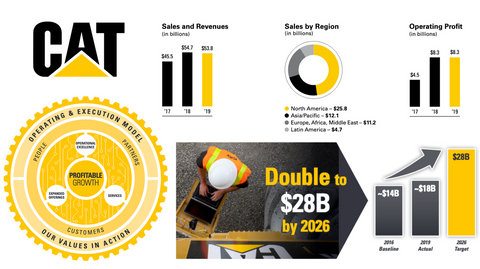

With 2019 sales and revenues of $53.800 billion, Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company principally operates through its three primary segments - Construction Industries, Resource Industries and Energy & Transportation - and also provides financing and related services through its Financial Products segment. Caterpillar is also a leading U.S. exporter. Through a global network of independent dealers and direct sales of certain products, Caterpillar builds long-term relationships with customers around the world.

Caterpillar Financial Highlights

| Fiscal Year | |

| Fiscal Year Ends | December 31, 2019 |

| Most Recent Quarter | June 30, 2020 |

| Profitability | |

| Profit Margin | 8.90% |

| Operating Margin | 13.20% |

| Management Effectiveness | |

| Return on Assets | 4.93% |

| Return on Equity | 28.92% |

| Income Statement | |

| Revenue | $46.53 Billion |

| Revenue Per Share | 84.78 |

| Quarterly Revenue Growth | -30.70% |

| Gross Profit | 14.46B |

| EBITDA | 8.58B |

| Net Income Avi to Common | 4.14B |

| Diluted EPS | 7.49 |

| Quarterly Earnings Growth | -71.70% |

| Balance Sheet | |

| Total Cash | 8.03B |

| Total Cash Per Share | 14.83 |

| Total Debt | 38.65B |

| Total Debt/Equity | 280.53 |

| Current Ratio | 1.5 |

| Book Value Per Share | 25.36 |

| Cash Flow Statement | |

| Operating Cash Flow | 5.72B |

| Levered Free Cash Flow | 3.46B |

Expanded Offerings

- Invested approximately $3.5 billion in research and development (R&D) during the past two years, resulting in a wide variety of new products across all segments.

- Launched 11 GC models to date, including six new models in 2019, which target customers who prioritize lifecycle value.

- Expanded portfolio to include a broader range of underground mining products.

- Introduced new products with fuel-efficiency benefits, including the D6 XE, the world’s first high-drive electric drive dozer.

- Responded to customers’ needs for reliable engines that are lighter, more efficient and powerful with two new engine platforms, the Cat C3.6 and C13B.

- Introduced the well service 3512E Tier 4 Final Dynamic Gas Blending™ dual fuel engine – the first and only Tier 4 Final well service dual-fuel engine in the industry.

- Started production of a new single trailer 5MW Solar turbine mobile generator.

- Launched the XQP30, XQP60, XQP100, XQ230, XQP1100 and XGC1900 family of switchable electric power rental packages.

2019-End Market Highlights

Construction Industries

Modest economic expansion and continued growth in construction activity in North America, in particular for road infrastructure, was offset by weaker demand in Asia/Pacific due to continued competitive pressures. Lower sales in 2019 were driven by changes in dealer inventories, partially offset by higher end-user demand.

Resource Industries

Mining customers increased capital expenditures as commodity prices were generally supportive of investments. Positive global economic growth drove increased sales for equipment supporting nonresidential construction activities, as well as quarry and aggregates activities.

Energy & Transportation

Declines in North American oil and gas resulted in weaker new equipment demand for well servicing and slowed timing of turbine project delivery of gas compression projects. Both industrial and power generation applications experienced moderate growth from higher end-user demand, while transportation sales were about flat.

Caterpillar Strategy

Caterpillar continues to execute their strategy for profitable growth, which has THREE PILLARS:

- Operational excellence

- Expanded offerings

- Services

Operational excellence includes the core competencies of safety, quality, Lean and a competitive and flexible cost structure.

Expanded offerings includes the growing equipment portfolio that meets a broad range of customer needs.

Services refers to the many ways that Caterpillar helps customers succeed after purchasing a product, including growing digital offerings. Successfully executing this strategy allows Caterpillar to improve operating profit and free cash flow – while providing better solutions to customers and creating more opportunities for people, partners and shareholders.

More on Caterpillar

- Caterpillar Contact Info

- Caterpillar Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology, R&D, Manufacturing, etc.

- Caterpillar Financial Insights

- Caterpillar SWOT Report

- Caterpillar Technologies in Use

- Caterpillar IT Budgets

- Caterpillar Social Media Profiles

- Caterpillar Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com