Citigroup Org Chart & Sales Intelligence blog

388 Greenwich Street

New York, NY 10013

United States

Main Phone: (212) 559-1000

Website: https://www.citigroup.com

Ticker Symbol: (NYSE: C)

Industry Sector: Financial Services, Banks—Diversified

Full Time Employees: 238,000

Annual Revenues: $70.75 Billion USD

Fiscal Year End: December 31, 2023

Citi on Social Media

Facebook | LinkedIn | Twitter | Instagram | Youtube

Citigroup Fortune 500 Rank: #44

Citigroup Forbes Global 2000 Rank: #27

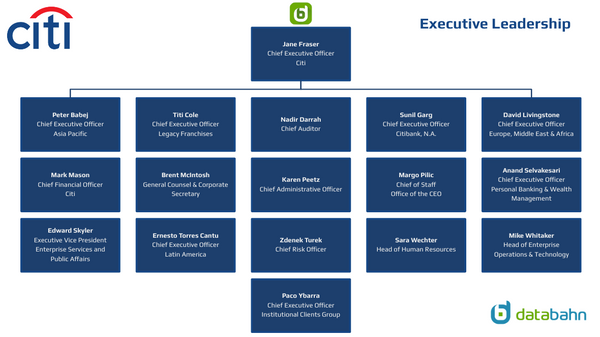

Who is the CEO of Citigroup?

Jane Fraser is CEO and Director at Citi

What do the Citigroup Org Charts look like?

Citi Org Chart PREVIEW

Download the Citigroup Org Chart & Sales Intelligence Report to see all of the Citi Org Charts.

Who are the decision-makers at Citigroup?

| NAME | TITLE | PHONE | |

| Jane Fraser | Chief Executive Officer, Citi | (212) 559-1000 | {first}.{last}@citi.com |

| Peter Babej | Chief Executive Officer, Asia Pacific | (212) 559-1000 | {first}.{last}@citi.com |

| Sunil Garg | Chief Executive Officer, Citibank, N.A. | (212) 559-1000 | {first}.{last}@citi.com |

| David Livingstone | Chief Executive Officer, Europe, Middle East & Africa | (212) 559-1000 | {first}.{last}@citi.com |

| Paco Ybarra | Chief Executive Officer, Institutional Clients Group | (212) 559-1000 | {first}.{last}@citi.com |

| Ernesto Torres Cantu | Chief Executive Officer, Latin America | (212) 559-1000 | {first}.{last}@citi.com |

| Titi Cole | Chief Executive Officer, Legacy Franchises | (212) 559-1000 | {first}.{last}@citi.com |

| Anand Selvakesari | Chief Executive Officer, Personal Banking & Wealth Management | (212) 559-1000 | {first}.{last}@citi.com |

| Mark Mason | Chief Financial Officer, Citi | (212) 559-1000 | {first}.{last}@citi.com |

| Karen Peetz | Chief Administrative Officer | (212) 559-1000 | {first}.{last}@citi.com |

| Nadir Darrah | Chief Auditor | (212) 559-1000 | {first}.{last}@citi.com |

| Zdenek Turek | Chief Risk Officer | (212) 559-1000 | {first}.{last}@citi.com |

| Margo Pilic | Chief of Staff, Office of the CEO | (212) 559-1000 | {first}.{last}@citi.com |

| Edward Skyler | Executive Vice President, Enterprise Services and Public Affairs | (212) 559-1000 | {first}.{last}@citi.com |

| Brent McIntosh | General Counsel & Corporate Secretary | (212) 559-1000 | {first}.{last}@citi.com |

| Mike Whitaker | Head of Enterprise Operations & Technology | (212) 559-1000 | {first}.{last}@citi.com |

| Sara Wechter | Head of Human Resources | (212) 559-1000 | {first}.{last}@citi.com |

Download the Citigroup Org Chart & Sales Intelligence Report to gain access to profiles of the key decision-makers at Citigroup.

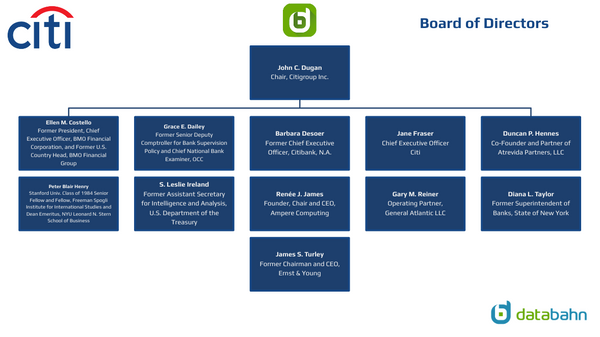

Who serves on Citigroup’s Board of Directors?

| NAME | TITLE | COMPANY |

| John C. Dugan | Chair, Citigroup Inc. | Citigroup Inc. |

| Jane Fraser | Chief Executive Officer, Citi | Citigroup Inc. |

| Duncan P. Hennes | Co-Founder and Partner of Atrevida Partners, LLC | Citigroup Inc. |

| S. Leslie Ireland | Former Assistant Secretary for Intelligence and Analysis, U.S. Department of the Treasury | Citigroup Inc. |

| James S. Turley | Former Chairman and CEO, Ernst & Young | Citigroup Inc. |

| Barbara Desoer | Former Chief Executive Officer, Citibank, N.A. | Citigroup Inc. |

| Ellen M. Costello | Former President, Chief Executive Officer, BMO Financial Corporation, and Former U.S. Country Head, BMO Financial Group | Citigroup Inc. |

| Grace E. Dailey | Former Senior Deputy Comptroller for Bank Supervision Policy and Chief National Bank Examiner, OCC | Citigroup Inc. |

| Diana L. Taylor | Former Superintendent of Banks, State of New York | Citigroup Inc. |

| Renée J. James | Founder, Chair and CEO, Ampere Computing | Citigroup Inc. |

| Gary M. Reiner | Operating Partner, General Atlantic LLC | Citigroup Inc. |

| Peter Blair Henry | Stanford Univ. Class of 1984 Senior Fellow and Fellow, Freeman Spogli Institute for International Studies and Dean Emeritus, NYU Leonard N. Stern School of Business | Citigroup Inc. |

Where is Citigroup investing in their business?

PREVIEW

Citi’s exit from China retail banking business to affect 1,200 employees

Dec 2022

Citigroup said it plans to wind down its consumer banking operations business in mainland China after failing to find a buyer for the business since first announcing plans to exit retail banking businesses in 14 international markets last year. The move will affect 1,200 employees and Citi said it would explore options for employees who wish to continue to work for the bank in China or across its global network. The American bank said it would continue to actively pursue sales for portfolios within the business, which include insurance, mortgages, loans and cards. The wind down does not include its institutional or wealth management businesses in China, the bank said. “While we explored multiple strategic options for our China consumer business over the past several months, we believe that this path makes the most sense and we are focused on a seamless transition for our clients, partners and colleagues,” said Titi Cole, CEO of Citi’s legacy franchises. Citigroup is in the process of exiting consumer banking businesses in Asia, Europe, the Middle East, Africa and Mexico as part of a refresh of its strategy.

Source

Citigroup is actively investing to improve automation, says CFO

Jul 2022

Investment in technology is also becoming a key expense driver for the bank. Expenses overall increased 8% for Citigroup, and 3% of that spend was driven by “transformation investments,” Mark Mason said, with two-thirds relating to risk, control, data and finance programs. “Approximately 25% of the investments in those programs are related to technology,” he said during the earnings call. “And as of today, we have over 9,000 people dedicated to the transformation.” Citi’s technology and transformation spend are geared toward consolidating its platforms and services in favor of cloud-based solutions, with the bank inking an agreement with a major software provider to both modernize and move its 16 ledger platforms to one cloud-based ledger over a multiyear period, according to its Friday earnings call.

Source

Citigroup Plans to Hire 4,000 Tech Staff to Tap Into ‘Digital Explosion’

Jun 2022

Citigroup Inc. plans to hire more than 4,000 tech staff to help move its institutional clients online in the wake of the pandemic. More than 1,000 of the recruits will join the markets technology team as part of an aggressive growth strategy, Jonathan Lofthouse, head of markets and enterprise risk technology, said in an interview. “We’re trying to digitalize as much of our client experience as possible, front and back, and modernize our technology,” he said. “Those firms that can digitalize fastest are going to create competitive advantage.” Banks are upgrading decades-old technology platforms to make services available remotely for both clients and workers, with multibillion-dollar programs that investors are watching closely for signs that this largess will eventually boost returns. At Citi, Chief Financial Officer Mark Mason said in March the lender raised tech spending by 10% to $10 billion last year. JPMorgan Chase & Co. boss Jamie Dimon said last month he just wants “to get it done” on the technology front, amid broader shareholder scrutiny of the bank’s expenses.

Data specialists are in particular demand across banking and the wider jobs market. Lofthouse said pay was a factor in getting new workers through the door, but training and flexible working models would help to keep them. Citi currently has more than 30,000 software engineers. “Everyone in lockdown suddenly had to do everything digitally, whether that was getting groceries delivered or watching more Netflix,” he said. “We’ve always seen the tech market to be competitive but particularly at the moment, coming out of the pandemic, we’ve seen a digital explosion across industries.”

Source

What are Citigroup executives saying about business performance?

Citigroup (C) Q3 2022 Earnings Call Highlights

October 14, 2022

Executives in Attendance

Jen Landis, Head of Investor Relations

Jane Fraser, Chief Executive Officer

Mark Mason, Chief Financial Officer

Comments from Jane Fraser -- Chief Executive Officer:

"We reported net income of $3.5 billion, EPS $1.63, and an ROTCE of 8.2%. We grew revenues by 6%, including a gain on sale of our consumer business in the Philippines. While we had excellent performance in some areas, our results could have been better in a few others."

"Services delivered another very strong quarter. TTS saw revenues up 40% year over year with growth in each business and in fees. Key drivers of our strategy such as wallet share, trade loan originations, and cross-border transactions are all trending strongly in the right direction and are ahead of our plan. Security Services was up 15% and despite assets under custody being impacted by the declines in equity markets."

"U.S. personal banking further solidified its growth trajectory, card sales, ANR, interest-earning balances, and customer acquisition all saw good growth and we continued to increase digital uptake. Retail Services joined branded cards and having double-digit revenue growth this quarter. Retail banking also grew contributing to a 10% overall revenue increase for the business."

"While our expenses are elevated as we continue to invest in our businesses, and in our transformation, we are managing them closely, and we remain on track to meet the full year guidance. As you know, the transformation is a multiyear effort, and we're committed to meeting the expectations of our regulators given the paramount importance of safety and soundness. We continue to be in constructive dialogues with them and are updating our execution plans as appropriate. Stepping back, I'm generally pleased with the advances we're making in the key drivers of the strategy we laid out for you in March."

Comments from Mark Mason -- Chief Financial Officer:

"In the third quarter, we reported net income of $3.5 billion and EPS of $1.63, with an ROTCE of 8.2% on $18.5 billion of revenues. Embedded in these results are pre-tax divestiture-related impacts of approximately $520 million, largely driven by a gain on the sale of the Philippines consumer business. Excluding divestiture-related impacts, EPS and ROTCE would have been $1.50 and 7.5%, respectively. In the quarter, total revenues increased 6% on a reported basis."

"Excluding divestiture-related impacts, revenues were down 1% as growth in net interest income was more than offset by lower noninterest revenues. Net interest income grew 18%, driven by the impact of higher interest rates across the firm and strong loan growth in PBWM. Noninterest revenues were down 12% on a reported basis and 28% excluding divestiture-related impacts, largely reflecting declines in investment banking, markets, and investment revenues in well. Total expenses of $12.7 billion increased 8% and 7%, excluding divestiture-related impacts, largely driven by transformation inflation and other risk and control initiatives."

"And sequentially, our net interest margin increased by seven basis points. On Slide 6, we show an expense walk for the third quarter with the key underlying drivers. As I mentioned earlier, expenses increased by 8% and 7%, excluding the impact of divestitures. 2% of the increase was driven by transformation investments with about two-thirds related to the risk controls, data, and finance programs, and approximately 25% of the investments in those programs are related to technology."

Source

What do the Citigroup financials look like?

|

Fiscal Year |

|

| Fiscal Year Ends | December 31, 2023 |

| Most Recent Quarter | September 29, 2022 |

|

Profitability |

|

| Profit Margin | 21.92% |

| Operating Margin | 27.72% |

|

Management Effectiveness |

|

| Return on Assets | 0.67% |

| Return on Equity | 7.89% |

|

Income Statement |

|

| Revenue | $70.75 Billion |

| Revenue Per Share | 36.12 |

| Quarterly Revenue Growth | -2.80% |

| Gross Profit | 74.99B |

| Net Income Avi to Common | 14.6B |

| Diluted EPS | 7.45 |

| Quarterly Earnings Growth | -25.10% |

|

Balance Sheet |

|

| Total Cash | 990.92B |

| Total Cash Per Share | 511.61 |

| Total Debt | 579.58B |

| Total Debt/Equity | N/A |

| Current Ratio | N/A |

| Book Value Per Share | 92.71 |

|

Cash Flow Statement |

|

| Operating Cash Flow | -2.11B |

Download the Citigroup Deep-Dive Report to see complete financial analysis and actionable insights

Where is Citigroup utilizing cloud technologies?

Cloud Engineer

Location: Irving, TX

The Infrastructure Technology Lead Analyst is an intermediate level role responsible for assisting with migration from Pivotal Cloud Foundry to OpenShift and help formalize the building blocks for the core infrastructure and migration strategy. Triaging and troubleshooting production issues and blameless postmortems for incidents. Researching and implementing ways to automate the management of our infrastructure. Collaborate closely with multiple team such as engineering, datacenter, vendor just to name few. Support development and production support teams across our growing development, UAT, and production environments on OpenShift. Building out uptime, latency, and error and capacity monitoring for the stack. Taking part in on-call rotation for support.

Technologies in use: OpenShift, Kubernetes, Docker

Lead Cloud/ECS Platform SME

Location: Tampa, FL

Works on the Citigroup ICG- Securities Services Technology- Infrastructure and Platform management team. Hands-on Cloud implementation with Microservices/ Platform delivery experience across a broad range of Cloud services. DevOps and CI/CD pipeline (GitHub, Jenkins, Artifactory, Maven). Understanding core AWS platform architecture, including areas such as: Organizations, Account Design, VPC, Transit Gateway, Subnet, segmentation strategies. Private Cloud Environment and application automation through Microservices architecture/ Engineering/ Design and Implementation. CloudFormation and third-party automation approach/strategy. Network connectivity, Direct Connect and VPN. Scripting capability and the ability to develop AWS environments as code. Backup and Disaster Recovery approach and design. Developing test plan, test cases, baselines, and conducting end-to-end testing.

Technologies in use: AWS, Micro services, OpenShift, AWS, Google, Azure, SQL, Windows, Linux, Oracle, Kafka, MQ, Tomcat, JBoss, Enterprise Container Solutions/OpenShift/ Cloud, AWS platform architecture (Containerization - Docker, Amazon EKS, AWS Directory Structure, Lambda, EC2, S3 bucket, Route 53, ELB, Amazon DocumentDB, Amazon Kafka, PostgreSQL

Cloud Engineering Manager (SVP) - Payments Express

Locations: Jersey City, NJ and Tampa, FL

The Applications Development Group Manager is a senior management level position responsible for accomplishing results through the management of a team or department in an effort to establish and implement new or revised application systems and programs in coordination with the Technology Team. The overall objective of this role is to drive applications systems analysis, be the technical SME and lead the programming activities. Payments Technology is undergoing tremendous transformation, leading the bank for AWS based transactional platform. Manage multiple teams of professionals to accomplish established goals and conduct personnel duties for team (e.g. performance evaluations, hiring and disciplinary actions). Provide strategic influence and exercise control over resources, budget management and planning while monitoring end results. Utilize in-depth knowledge of concepts and procedures within own area and basic knowledge of other areas to resolve issues. Ensure essential procedures are followed and contribute to defining standards. Integrate in-depth knowledge of applications development with overall technology function to achieve established goals.

Technologies in use: Cloud Native Technologies (Public Cloud AWS / Azure / GCP)

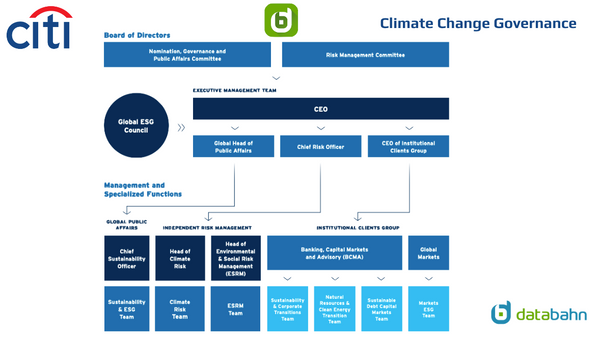

Citigroup ESG Highlights

MORE ON CITIGROUP

Citigroup Contact Information

Citigroup Org Charts on Corporate Structure, Executive Leadership, Board of Directors & more

Citigroup Financial Insights

Citigroup SWOT Report

Citigroup Technologies in Use

Citigroup IT Budgets

Citigroup Social Media Profiles

Citigroup Actionable Sales Triggers Events

Would you like to see the Citigroup Org Charts & Sales Intelligence report? Send us an email at info@databahn.com