JP Morgan Chase Org Chart and Sales Intelligence blog

JPMorgan Chase & Co.

383 Madison Avenue

New York, NY 10179

United States

Main Phone: (212) 270-6000

Website: http://www.jpmorganchase.com

Ticker Symbol: (NYSE: JPM)

Sector(s): Financial Services

Industry: Banks—Diversified

Full Time Employees: 288,470

JPMorgan Chase on Social Media

Facebook | LinkedIn | Instagram | Youtube

JPMorgan Fortune 500 Rank

JP Morgan Chase & Co. 2021 Fortune 500 Rank: #19In 2022, JPMorgan Chase ranked 24 on the Fortune 500

JPMorgan Chase Priorities

Hiring: Grow market share domestically and internationally by hiring advisors and investment professionals.

Digital and Data: Digitize everything, and leverage data to deliver insights to clients, investors and advisors.

Environmental, Social and Governance: Rank among the top three in active sustainable funds.

China: Become the #1 foreign asset manager onshore in China.

Recent promotions and executive announcements at JPMorgan in 2022

As of October 19, 2022, Aaron Iovine has been appointed as the Head of Crypto Regulatory Policy

Source

Sophie Qian was announced as the Head of Equity Capital Markets for Southeast Asia in October 2022

Source

In August of 2022, Inge Grobbelaar was been promoted to Vice President

Source

JPMorgan Chase announced in an internal memo at the end of March 2022 that the company has hired David Miree as Global Head of Diversity, Equity and Inclusion

Source

Thelma Ferguson will become Vice Chairman of Commercial Banking (CB) in March 2022.

Source

JPMorgan Chase Business Outlook

For the full fiscal year 2021, JPMorgan Chase executives expect net interest income to be roughly $55 billion, dependent on the market. Additionally management experts adjusted expense to be roughly $69 billion, which includes accelerated contributions to JPMorgan Chase's Foundation in the form of equity investments and higher revenue-related expense.

Business Segment Outlook

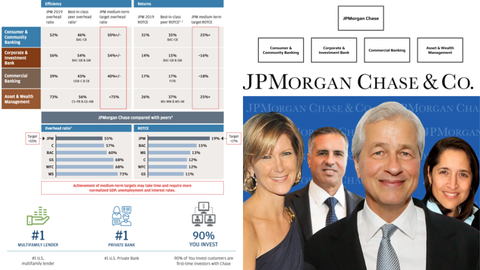

There are four major reportable business segments – Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking and Asset & Wealth Management. In addition, there is a Corporate segment.

In the fourth quarter of 2020, JPMorgan Chase transferred assets, liabilities, revenue, expense and headcount associated with wealth management clients from AWM to the J.P. Morgan Wealth Management business unit within CCB. Period amounts have been revised to conform with the current presentation, including the transfer of approximately 1,650 technology and support staff during the second and third quarters of 2020.

In CB, JPMorgan Chase is executing a long-term, disciplined strategy, focused on adding clients and delivering solutions. Throughout 2020, the company remained focused on strategic priorities and continued to invest and innovate.

The JP Morgan Org Chart Report covers key business units including Consumer & Community, Corporate & Investment Banking, Commercial Banking, and Asset & Wealth Management. databahn goes further into the lines of business by charting HR, Finance, IT, Operations and more.

PREVIEW

Download the JPMorgan Chase & Co. Deep-Dive Report to see the full 14 organizational charts.

The JP Morgan Contact Info Spreadsheet is a directory of 1000+ names, titles, phone numbers, and addresses.

PREVIEW

| NAME | TITLE | MAIN PHONE | DIRECT PHONE | |

| Daniel E. Pinto | Co-President and Chief Operating Officer | daniel.pinto@jpmorgan.com | (212) 270-6000 | (212) 834-ZZZZ |

| Jeremy Barnum | Chief Financial Officer | jeremy.barnum@jpmorgan.com | (212) 270-6000 | (212) 834-ZZZZ |

| Matthew Leblanc | Chief Investment Officer | matthew.j.leblanc@jpmorgan.com | (212) 270-6000 | (212) 648-ZZZZ |

| Lori A. Beer | Global Chief Information Officer | lori.a.beer@jpmchase.com | (212) 270-6000 | (212) 622-ZZZZ |

| Beth Tardalo | Executive Assistant to the Chairman and CEO | beth.a.tardalo@jpmorgan.com | (212) 270-6000 | (212) 270-ZZZZ |

Download the JPMorgan Chase & Co. Deep-Dive Report to gain contact information for all 1,134 contacts.

JPMorgan Chase Executive Leadership Team

| Jamie Dimon | Chairman and CEO |

| Peter L. Scher | Vice Chairman |

| Ashley Bacon | Chief Risk Officer |

| Jeremy Barnum | Chief Financial Officer |

| Lori A. Beer | Global Chief Information Officer |

| Mary Callahan Erdoes | Asset & Wealth Management CEO |

| Sanoke Viswanathan | CEO of The International Customer Growth Initiatives |

| Marianne Lake | Co-CEO of Consumer & Community Banking |

| Jennifer A. Piepszak | Co-CEO of Consumer & Community Banking |

| Daniel E. Pinto | Co-President and Chief Operating Officer |

| Gordon A. Smith | Co-President and Chief Operating Officer |

| Carlos Hernandez | Executive Chair of Investment & Corporate Banking |

| Teresa Heitsenrether | Global Head of Securities Services |

| Takis Georgakopoulos | Global Head of Wholesale Payments |

| Marc Badrichani | Head of Global Sales and Research |

| Robin Leopold | Head of Human Resources |

| Troy Rohrbaugh | Head of Global Markets |

| Stacey Friedman | General Counsel |

Highlights from JP Morgan CEO Letter to Shareholders

Jamie Dimon

Chief Executive Officer

Corporate Contributions

"We provided critical development financing and attracted additional investment, such as funding through our new development finance institution (DFI) to support sustainable development. In 2020, the DFI mobilized $140 billion toward these goals — helping, for example, with Uzbekistan’s first local currency issuance in international markets to finance the country’s health, education and transport sectors and with the Republic of Georgia’s debut green bond to support that country’s access to water, power and sanitation."

"We raised $12 billion in capital and credit to help finance infrastructure projects across the United States. This included $1.3 billion in credit assistance to New York City’s Metropolitan Transportation Authority to help deal with the serious impacts of COVID-19 on the city’s transportation system."

"We designed branches, products, services and digital solutions to help clients and customers better manage their financial daily lives, with particular focus on underserved communities and families. In 2020, we continued to open new branches in new markets across the United States with 30% opening in low- to moderate-income communities by 2023."

Cloud and Digital Transformation

"We already extensively use AI, quite successfully, in fraud and risk, marketing, prospecting, idea generation, operations, trading and in other areas – to great effect, but we are still at the beginning of this journey. And we are training our people in machine learning – there simply is no speed fast enough."

"We need to properly invest, on an ongoing basis, in modernizing infrastructure. Virtually everyone agrees that we have done a woefully inadequate job investing in our infrastructure – from highways, ports and water systems to airport modernization and other projects. One study examined the effect of poor infrastructure on efficiency (for example, poorly constructed highways, congested airports with antiquated air traffic control systems, aging electrical grids and old water pipes) and concluded this could all be costing us hundreds of billions of dollars per year. Some economists estimate that a proper infrastructure investment plan could add 0.3% growth annually to our GDP – and it would improve competitiveness across many industries while opening up new investment opportunities."

Download the JPMorgan Chase & Co. Deep-Dive Report to gain access to profiles of the key decision-makers at JPMorgan Chase.

JPMorgan Chase Board of Directors

| NAME | TITLE | COMPANY |

| Jamie Dimon | Chairman of the Board and CEO | JPMorgan Chase & Co. |

| Linda B. Bammann | Retired Deputy Head of Risk Management | JPMorgan Chase & Co. |

| Stephen B. Burke | Senior Advisor | Comcast Corporation |

| Todd A. Combs | Investment officer | Berkshire Hathaway Inc |

| James S. Crown | Chairman and Chief Executive Officer | Henry Crown and Company |

| Timothy P. Flynn | Chairman | KPMG International |

| Mellody Hobson | Co-CEO | Ariel Investments, LLC |

| Michael A. Neal | Retired Vice Chairman | General Electric Company |

| Phebe N. Novakovic | Chairman and Chief Executive Officer | General Dynamics |

| Virginia M. Rometty | Retired President and Chief Executive Officer | IBM |

JPMorgan Chase Financial Highlights

| Fiscal Year | |

| Fiscal Year Ends | December 31, 2021 |

| Most Recent Quarter | July 13, 2021 |

| Profitability | |

| Profit Margin | 37.18% |

| Operating Margin | 46.91% |

| Management Effectiveness | |

| Return on Assets | 1.39% |

| Return on Equity | 17.36% |

| Income Statement | |

| Revenue | $128.65 Billion |

| Revenue Per Share | 41.95 |

| Quarterly Revenue Growth | 45.00% |

| Gross Profit | 102.06B |

| Net Income Avi to Common | 46.06B |

| Diluted EPS | 14.99 |

| Quarterly Earnings Growth | 154.90% |

| Balance Sheet | |

| Total Cash | 1.47T |

| Total Cash Per Share | 491.27 |

| Total Debt | 721.53B |

| Book Value Per Share | 84.85 |

| Cash Flow Statement | |

| Operating Cash Flow | -73.08B |

JPMorgan Chase Sales Trigger Events

PREVIEW

JPMorgan To Invest $50M In Vera Whole Health, A Medical Subscription Startup

August 5, 2021

The company, J.P. Morgan Chase is investing in Vera Whole Health with $50 million. This is JPMorgan's first investment for its healthcare division — Morgan Health. This division launched in May 2021. J.P. Morgan will also begin offering Vera's subscription plan to its employees.

Ryan Schmid, Chief Executive Officer of Vera said in a interview that healthcare today, is largely “transactional,” with the priority being the number of procedures versus outcomes. “Which I think creates some perverse incentives,” Schmid said. “In our care model, our teams are paid a salary plus bonus, and that bonus is tied specifically to their outcomes.”

Dan Mendelson, Chief Executive Officer of Morgan Health said that Vera Whole Health will be one of the many options for employees. Mendelson added that Vera offers a “higher level of care” which could mean a huge spike in demand.

Source

JPMorgan Chase is hiring over 500 wealth management advisers

July 22, 2021

Recently, JPMorgan Chase executives said the bank plans to hire more than 500 financial advisers within the next five to seven year. JPMorgan is looking to rapidly expand its wealth management services. Currently JPMorgan has 450 brokers under JPMorgan Advisors and this plan will double that number. “We are investing in this business,” said Phil Sieg, chief executive officer of J.P. Morgan Advisors. “We want to grow to 1,000 advisers relatively quickly.” JPMorgan Chase CEO Jamie Dimon claims growing JPMorgan's wealth offerings has been a top prority.

J.P. Morgan Advisors operates under JPMorgan Chase & Co.'s wealth management division. The division is led by Kristin Lemkau, CEO - J.P. Morgan Wealth Management.

Source

JP Morgan Collaborates with NMI to Offer New Payment Services in Europe

July 21, 2021

JPMorgan is currently the #1 acquirer of web transactions in Europe for the sixth year running. JPMorgan plans to utilize NMI's mPOS, retail, and mobile technologies to assist customers in a select group of European countries. NMI's solutions primarily focus on contactless enablement. JPMorgan's merchant customers will be able to utilize innovative card-present capabilities as they return to stores.

Head of Product for EMEA Merchant Services, Basil Bailey at JP Morgan said, “We are focused on creating new ways for merchants to manage payments and streamline their operations so they can focus on growth,“ said n. “This is an important step in our European omnichannel payments journey, and complements the existing suite of products we offer merchants in the region.”

“NMI is pleased to launch this workstream with J.P. Morgan and to help play a role in enabling retail payments across select markets in Europe,” says Kyle Pexton, President of NMI.

Source

Global CIO says JPMorgan Chase is working to grow North Texas as a technology hub

July 14, 2021

Lori Beer, Global Chief Information Officer at JPMorgan Chase stated that the market in North Texas is quickly adding employees within the technology sector. "We definitely have sites that aren't as big as here (Plano, TX) but when we look at our talent strategy, we're obviously looking at key market places where we could have a density of talent where we would see that talent grow.

Within the last two years, JPMorgan Chase has hired over 1,500 employees in the Plano, TX campus. Beer says that the bank plans to hire an additional 1,000 more over the next two years.

Source

J.P. Morgan to acquire OpenInvest, and put the bank in position to enhance values-based investing

June 29, 2021

The bank announced that it will acquire acquire OpenInvest to aid employees in value-based investments. OpenInvest is a financial technology company and was founded in 2015. OpenInvest will integrate with J.P. Morgan’s Private Bank and Wealth Management offerings.

“Clients are increasingly focused on understanding the environmental, social, and governance (ESG) impact of their portfolios and using that information to make investment decisions that better align with their goals,” said Mary Callahan Erdoes, Asset & Wealth Management CEO.

“Our partnership with J.P. Morgan combines leading ESG technologies with America’s largest bank and the ability to reach nearly half of all American households,” said Joshua Levin, Co-founder and Chief Strategy Officer, OpenInvest.

“OpenInvest will be a powerful resource for our advisors to use in helping clients personalize their investments,” said Michael Camacho, CEO, J.P. Morgan Wealth Management Solutions.

Source

Global Co-Heads named for JPMorgan investment banking group

June 3, 2021

After opening 200 bank branches JPMorgan Chase speaks on opening an additional 200 more

June 2, 2021

JPMorgan Chase & Co is already halfway through a launched campaign to open 400 new bank branches. The bank said in a statement that JPMorgan Chase & Co. is working to become the first U.S. bank to have a brick and mortar presence in every state except Alaska and Hawaii. Back in 2018, JPMorgan Chase said it would open 400 branches in new markets to expand existing clients, said head of Chase branch expansion Dan Deegan.

Dan Deegan, Head of Chase Branch Expansion said, "In many of the cities we've gone to, the other lines of businesses at JPM had been here for 20 years". Since October 2018, JPMorgan has opened branches in 16 new states.The banks strategy is to open in major metropolitan areas in new states, for example, Albuquerque, New Mexico, and Portland, Maine. The initiative estimates a hiring of over 3,000 bank staffers for the increase in the number jobs, a bank spokeswoman said.

Source

JPMorgan Chase & Co. Launches New Business Unit, Morgan Health

May 20, 2021

The company announced details about Morgan Health, a new business unit that will focus on improving efficiency and equity of employer-sponsored healthcare. Dan Mendelson, CEO of Morgan Health will lead the new group. Mendelson will report to Peter Scher, Vice Chairman of JPMorgan Chase & Co.

“JPMorgan Chase has been focused on improving healthcare for its employees for many years,” stated Dan Mendelson, CEO of Morgan Health. “We are going to take what we’ve learned and accelerate healthcare innovation in the employer-sponsored healthcare market, partnering with and investing in companies that share our goals, and measuring key health outcomes to show what works.”

Morgan Health will be headquartered in Washington, DC. Health equity will be an important focus for Morgan Health and for JPMorgan Chase employees. Additionally, Morgan Health plans to use its financial capital to drive innovation.

Source

JPMorgan Chase asks CEO contenders to oversee the company's consumer operation

May 18, 2021

The bank is putting two contenders for the CEO position in charge of JPMorgan Chase's consumer-banking operation. The company is searching for a new Chief Executive Officer to succeed Jamie Dimon. Jennifer Piepszak, Chief Financial Officer and Marianne Lake, Chief of Consumer Lending are taking control of consumer and community bank. Gordon Smith who currently oversees consumer and community bank is retiring at the end of 2021.

JPMorgan Chase's head of global research, Jeremy Barnum will become the Chief Financial Officer. All corporate moves are effective immediately.

Source

Head of Fintech and Innovation for Wholesale Payments Hired by JPMorgan Chase & Co.

March 9, 2021

Jeremy Balkin, Former HSBC Holdings Plc executive has been hired as head of fintech and innovation for wholesale payments. In this new role Balkin oversees innovation initiatives and fintech for wholesale payments. Previously HSBC in the United States Balkin served as head of innovation and strategic digital partnerships.

The appointment of Jeremy Balkin comes as banks work to invest in financial technology to improve digital offerings for clients. JPMorgan's wholesale payments division also appointed Brad Brodigan, former PayPal Holdings Inc executive as global head of small and medium business for merchant services. Brodigan will be responsible for sales and partnerships, according to JPMorgan Chase & Co.

Source

JPMorgan begins its journey into retail banking across Europe with digital launch in UK

January 27, 2021

JPMorgan Chase has announced that it will launch a coordinated venture on the UK retail banking market. This begins with opening a digital-only bank in mid-2021. The bank will work under the Chase brand. JPMorgan is now the second Wall Street firm to enter the UK market in recent memory.

Co-President, Daniel Pinto, of JPMorgan, said: “Our decision to launch a digital retail bank in the UK is a milestone, introducing British consumers to our retail products for the first time. This new endeavour underscores our commitment to a country where we have deep roots, thousands of employees and offices established for over 160 years.”

Source

Download the JPMorgan Chase & Co. Deep-Dive Report to gain access to all 63 sales trigger events.

JPMorgan Chase Earnings Call Highlights

PREVIEW

JPMorgan Chase & Co. (JPM) Q2 2021 Earnings Call

July 13, 2021

Executives in Attendance:

- Jamie Dimon - Chairman and CEO

- Jeremy Barnum - CFO

Analysts Present:

- Glenn Schorr - Evercore ISI

- John McDonald - Autonomous Research

- Ken Usdin - Jefferies

- Jim Mitchell - Seaport Global Securities

- Mike Mayo - Wells Fargo Securities

- Ebrahim Poonawala - Bank of America Merrill Lynch

- Steven Chubak - Wolfe Research

- Matt O'Connor - Deutsche Bank

- Gerard Cassidy - RBC Capital Markets

- Betsy Graseck - Morgan Stanley

- Charles Peabody - Portales Partners

Comments from Jeremy Barnum - CFO:

"The Firm reported net income of $11.9 billion, EPS of $3.78 on revenue of $31.4 billion and delivered a return on tangible common equity of 23%. These results include $3 billion of credit reserve releases."

"Touching on a few highlights. Combined debit and credit spend was up 45% year on year and more importantly up 22% versus the more normal pre-COVID second quarter of 2019. It was an all-time record for IB fees, up 25% year on year, driven by advisory and debt underwriting. We saw particularly strong growth in AWM with record long-term flows as well as record revenue."

"Our omnichannel strategy continues to deliver. We are more than halfway through our initial market expansion commitment as we have opened more than 200 new branches out of our goal of 400, which have exceeded our expectations by generating $7 billion in deposits and investments. And we are planning to be in all 48 contiguous states by the end of the summer."

"Digital trends continue to be strong as retail mobility recovers at a faster pace than branch transactions, which are still down more than 20% versus 2019. Active mobile users grew 10% year-on-year to over 42 million, and total digital transactions per engaged customer were up 12%. Expenses of $7.1 billion were up 4% year-on-year, driven by continued investments and higher volume and revenue-related expenses."

More on JPMorgan Chase & Co.

- JPMorgan Chase Contact Information

- JPMorgan Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology, R&D, Manufacturing, etc.

- JPMorgan Financial Insights

- JPMorgan SWOT Report

- JPMorgan Technologies in Use

- JPMorgan IT Budgets

- JPMorgan Social Media Profiles

- JPMorgan Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com