Explore JPMorgan Chase Company Profile Analysis

Sale price

Price

$ 3,550.00

Regular price

JPMorgan Chase Company Profile & Org Chart Report

December 11, 2024

JPMorgan Chase & Co.

383 Madison Avenue

New York, NY 10179

United States

Main Phone: (212) 270-6000

Website: https://www.jpmorganchase.com

Industry Sector: Financial Services, Banks—Diversified

Full Time Employees: 288,474

Annual Revenues: $145.98 Billion USD

Fiscal Year End: December 31, 2024

CEO: James Dimon, Chairman & CEO

JPMorgan Chase is ranked #12 on the 2024 Fortune 500 list

JPMorgan Chase Org Chart Preview - Corporate Structure

JPMorgan Chase Org Chart Preview - Risk & Governance

What can I expect to see in the JPMorgan Chase deep dive report?

- Comprehensive JPMorgan Chase Business Description and Financial Snapshot

- Latest Earnings Call Highlights

- Hundreds of accurate JPMorgan Chase Decision Makers and Influencers in an Excel spreadsheet report. (.XLS)

- Detailed JPMorgan Chase Org Charts on corporate structure, board of directors, and other JPMorgan Chase leadership from the business segments and lines of business (HR, Technology, Marketing). The org chart report is available in PowerPoint and PDF format (.PPT and PDF).

- Hand curated content from selected articles, interviews, case studies, and success stories (representing dozens of hours of research)

- Technology Executive Insights to existing IT & telecom systems, projects, initiatives, and internal code names for applications, systems, and IT business units

- JPMorgan Chase SWOT Report - Strengths, Weaknesses, Opportunities and Threats

- JPMorgan Chase PESTLE Report - Political, Economic, Social, Technological, Legal and Environmental

- Insights gleaned from technology-related JPMorgan Chase job descriptions

- Important excerpts and highlights from the JPMorgan Chase Annual Report (10-K), Proxy Statement, Investor Presentation, and ESG Report

Is JPMorgan Chase contact info included in the deep dive report?

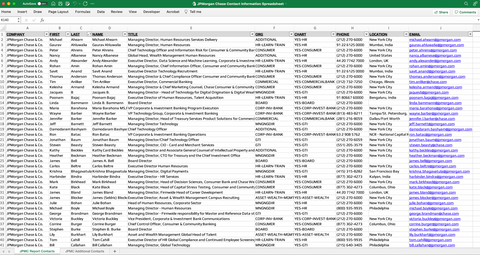

Yes, we include a separate JPMorgan Chase contact info spreadsheet listing the names, job titles, addresses, phone numbers, email addresses, and other contact intelligence. The JPMorgan Chase contact spreadsheet can be customized based on geo-location of the contact, their management level (Chief, EVP/SVP, VP, Director, and Manager), and the functional area (marketing, finance, HR, IT, legal, operations, supply chain, engineering, regulatory, etc.).

Are the JPMorgan Chase executives included in the contact info spreadsheet?

Yes, all of the JPMorgan Chase executives are included in the contact info spreadsheet along with their job title, email address, direct office phone number, their mailing address, and their location (city/state).

What are some of the reasons to purchase the JPMorgan Chase Org Chart & Sales Intelligence Report?

- Create a better and more informed JPMorgan Chase RFP Response proposal

- Brief your C-level executives before a sales call

- Eliminate the time it takes to build an JPMorgan Chase strategic account plan

- Develop more effective JPMorgan Chase account based marketing (ABM) programs

- Discover sales opportunities you're not aware of

- Understand the competitive landscape in the account

- Ramp up new sales reps faster in new accounts

- Need accurate JPMorgan Chase org charts & contact info

- Insights into JPMorgan Chase IT projects & initiatives

- Expand footprint in existing large enterprise accounts

OUR GUARANTEE

If you're not completely satisfied with the report, we will refund the total purchase amount.

JPMorgan Chase Org Chart & Sales Intelligence Report document deliverables are available for immediate download after purchase

Have questions? Send an email to info@databahn.com

Inside JPMorgan Chase Company Profile: In-depth Analysis

Key Highlights

- JPMorgan Chase & Co. is a top name in global financial services with assets over trillions of dollars.

- This company's history goes back many years and includes many mergers and acquisitions. A key moment was when J.P. Morgan & Co. combined with Chase Manhattan Corporation, making it a major banking player.

- Its operations cover four main areas: Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking, and Asset & Wealth Management. They serve individuals, businesses, and big institutions well.

- To stay on top, JPMorgan Chase works hard on technology that improves digital banking and fintech, making it better for customers and more efficient for their tasks.

- With its worldwide presence, strong financial performance, and smart leadership, JPMorgan Chase keeps changing the financial world.

Introduction

JPMorgan Chase & Co., based in the busy financial center of New York City, showcases its strong financial skills and lasting history. This multinational company is not only the largest bank in the United States but also the world’s largest bank, including its significant operations at the JPMorgan Chase Tower, and a key player in the global financial scene. The influence of JPMorgan Chase & Co. is felt worldwide, affecting different industries and economies.

The Origins of JPMorgan Chase

The story of this powerful financial institution goes back a long way. It is linked to many banking companies. It starts when the Chase Manhattan Company was set up in 1799. This was an important part of early American banking. The story got a big boost in 1871 when J.P. Morgan & Co. was founded. This name is well-known for its creativity and power in finance.

For more than a hundred years, these banks found their paths in a changing financial world. They left signs in many areas of business. However, it was not until the year 2000 that their paths came together. This was a key year when J.P. Morgan & Co. and Chase Manhattan Corporation joined forces. This merger created JPMorgan Chase & Co., a company ready to change the face of the finance industry.

Founding Entities and Key Mergers

JPMorgan Chase, as we see it today, is the result of many mergers and purchases. Each step has added to the company’s large size and wide range of services. This process brought together some of the biggest names in banking and finance. Now, it is the largest bank in the United States.

One important merger is between J.P. Morgan & Co. and Chase Manhattan Corporation. This happened in 2000 and was a big moment for the company. It combined the strengths of two major players, making JPMorgan Chase a leader in global finance. This merger created a huge bank with more customers, a wider reach, and a variety of services.

Through these smart moves, and by buying banks like Bank One, Bear Stearns, Washington Mutual, Texas Commerce Bank, and Great Western Bank, JPMorgan Chase has become a strong name in finance. The company's growth shows a trend of more mergers in banking, leading to the rise of large financial groups that offer many services in one place.

Evolution into a Financial Giant

JPMorgan Chase has become well-known because of its ability to adapt and change in the fast-moving financial markets. The company has always managed to get through tough economic times and come out even better. It has a talent for spotting chances when crises happen. The big decisions it made, like buying Bear Stearns and Washington Mutual during the 2008 crisis, have been key to its growth.

As an important part of the U.S. financial system, JPMorgan Chase is crucial to the Federal Reserve. It is known as a primary dealer, which means it takes part in market activities that affect money policy. This close connection to regulatory bodies highlights the company’s importance in shaping the economy of the country.

In addition, JPMorgan Chase is the largest investment bank in the world in terms of total assets when it comes to revenue. Its investment banking division offers many services. These include helping with securities, advisory services for mergers and acquisitions, and trading solutions. The success of this part of the business comes from its global presence, strong industry knowledge, and a large network of investors.

Organizational Structure and Leadership

At JPMorgan Chase, a carefully organized structure helps run its complex operations. This design aims to improve efficiency and create teamwork across the company’s different areas. The company has four main parts: Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking, and Asset & Wealth Management.

In addition to these four areas, there is a Corporate Functions and Technology division. This team is essential for connecting all parts of the bank and advancing its technology. They help support daily operations, manage risks, ensure rules are followed, and push for new ideas. The leadership team, made up of experienced experts, is important for guiding JPMorgan Chase toward growth and success.

Overview of the Four Main Segments

JPMorgan Chase has four main parts in its operations. Each part serves different clients and offers special financial products and services.

- The Consumer & Community Banking part helps individual customers and small businesses. They offer a wide range of banking solutions like checking and savings accounts, mortgages, credit cards, and auto loans. This part is very important for the bank's retail strategy. It helps promote financial inclusion and supports local communities.

- The Corporate & Investment Bank focuses on large corporations, governments, and institutional investors. This part provides many services such as investment banking, securities trading, treasury and securities services, and prime brokerage. JPMorgan Chase is well-known worldwide for its work in investment banking, being involved in many important mergers, acquisitions, and capital market deals.

- Finally, the Asset & Wealth Management part manages investments for individuals, families, foundations, and endowments. It manages trillions of dollars in assets, making it a global leader. They offer various investment products like mutual funds, hedge funds, private equity, and real estate. This part uses the bank's expertise in financial markets to provide tailored investment solutions that match clients' risk profiles and financial goals.

Role and Impact of Jamie Dimon

Jamie Dimon is the CEO and Chief Operating Officer of JPMorgan Chase & Co. since 2006 and the Chairman since 2007. He is known as a key figure in global finance and for his involvement with organizations like the Bank Policy Institute. Many respect him for his smart planning, strong leadership, and dedication to the company's long-term success.

Under his leadership, JPMorgan Chase faced the challenges of the 2008 financial crisis and came out stronger, showcasing principles learned at Harvard Business School and during his time at Tufts University. This made the bank a stable force and a leader in the financial services industry. Dimon has a gift for seeing economic trends and risks. He often makes strong and unique decisions that help the bank succeed. He also speaks out for responsible banking and has influenced rules that were made after the financial crisis.

Jamie Dimon, as JPMorgan Chase CEO, supports technology and has led the bank's move toward digital solutions. He saw early on how technology could change financial services. Dimon's vision goes beyond regular banking. He helps the company look into new areas, like blockchain and digital currencies. This keeps JPMorgan Chase at the forefront of innovation.

Lori Beer's Influence as Global CIO

Lori Beer is the Global Chief Information Officer and Executive Vice President of JPMorgan Chase & Co. She plays a key role in the bank. She leads a team worldwide that works on new technology for all business areas. Beer has been recognized and is striving for inclusion in the hall of fame for her main focus to use technology to improve customer experiences, streamline processes, and boost growth.

She understands that technology is always changing. So, she strongly supports using the latest tools like cloud computing, artificial intelligence, and blockchain. This helps JPMorgan Chase & Co. stay ahead of the competition. She also promotes strong cybersecurity efforts. Beer knows that protecting customer data and keeping the bank's systems safe is very important in our digital world.

Beer's leadership is more than just about technology skills. She builds a culture of innovation at the bank. She encourages teamwork and the discovery of new technologies. With her leadership, JPMorgan Chase is ready to face the future of finance. They aim to use technology in ways that offer great customer experiences and foster steady growth.

In-Depth Analysis of Business Segments

To really understand JPMorgan Chase, you need to look closely at its four main business areas. These areas are not just separate parts; they work together and support each other. They combine their strengths to build a strong financial system.

Each area has its own important job. They help with everyday banking for millions of people while also handling the challenges of global financial markets. This teamwork helps the company succeed. It drives its impressive growth and builds its strong reputation as a leader in the financial world.

Consumer & Community Banking (CCB)

JPMorgan Chase's Consumer & Community Banking (CCB) segment aims to help people and local communities. This part of the bank is important for offering banking services to individuals and small businesses. They use their knowledge in consumer finance and work in the community to help improve financial health and encourage growth in local economies. Through new projects and smart partnerships, the CCB division keeps working on JPMorgan Chase's promise to take care of their customers and support community development.

Corporate & Investment Bank (CIB)

JPMorgan Chase's Corporate & Investment Bank (CIB) plays a key role in the financial services industry. It is based in New York City. The CIB is known for its strengths in investment banking and asset management. It operates globally, serving a wide range of clients and markets. The CIB is strong in the United States and other countries. It competes with major players like Morgan Stanley and Goldman Sachs. Led by a respected board of directors and a skilled executive team, the CIB has a great reputation for innovation and being a leader in the market. It makes important contributions to the financial markets around the world.

Commercial Banking (CB)

JPMorgan Chase's commercial banking (CB) division is known for its smart way of helping businesses of all sizes. They have a global reach and offer many financial services. CB meets the different needs of corporate clients around the world. With their skills in investment banking and asset management, JPMorgan Chase creates special solutions. These solutions help businesses improve cash flow, manage risks, and grow. By focusing on clients and using new technology, CB shows it wants to help businesses and boost the economy. As they work in a complicated financial world, JPMorgan Chase's CB division continues to lead the industry.

Asset & Wealth Management (AWM)

The JPMorgan Chase Company Profile highlights the Asset & Wealth Management (AWM) division. This part of the financial services company is known for its skill in financial services. Based in New York City, AWM specializes in investment banking and asset management. It serves clients in the United States and around the world.

They focus on growing market capitalization. Because of this, JPMorgan Chase is one of the largest banks globally. The AWM's smart strategy shows in its private banking services and offerings for institutional investors. This makes them an important player in the financial markets.

Technological Innovations at JPMorgan Chase

JPMorgan Chase knows that the future of finance depends on technology. That's why the company is investing a lot in new tech for every part of its business. They realize that using the latest technologies is essential to stay ahead in a world that is becoming more digital.

JPMorgan Chase is working to make online banking better for customers. They also are using artificial intelligence to spot fraud and manage risk. The company is always looking at new technologies to make its work better, improve efficiency, and offer great services to its customers.

Digital Banking Advancements

JPMorgan Chase is leading the way in digital banking. They are changing how customers manage their money and improving the banking experience. The bank has invested a lot in its digital systems. This has led to strong online platforms and easy-to-use mobile apps. Now, customers can manage their accounts, make transactions, pay bills, and access many financial services easily.

JPMorgan Chase understands that today's customers want smooth and personal digital experiences. They are always adding new features to make things better. This includes options like fingerprint login, voice commands for transactions, and tailored financial advice. These features help customers manage their money better and give them more control and clarity.

The bank also works with and invests in new fintech startups. These partnerships bring speed and special skills to boost digital banking. This shows JPMorgan Chase's commitment to staying ahead with new technology, welcoming innovation, and helping to shape the future of financial services.

Investments in Fintech

JPMorgan Chase knows that new ideas in the financial services industry come from fast changes in financial technology, or fintech. To keep up and stay competitive, the bank invests heavily in this area. It understands that it must use new technologies and work with startups that are changing the way banks usually operate.

By investing in fintech companies, JPMorgan Chase can access new technology, skilled workers, and creative business ideas. This helps the bank improve its existing banking services and create new products and services. These investments place the bank in a good position to take advantage of new trends in financial services.

Additionally, JPMorgan Chase builds a culture of innovation within its own team. It creates labs and spaces where its employees can try new ideas and test new technologies. This strategy of both investing in fintech companies and encouraging fresh ideas inside helps the bank stay ahead in tech and lead changes in the financial services industry.

Global Presence and Market Influence

JPMorgan Chase is a big name in global finance, and it is not just based in New York City. JP Morgan Chase operates all over the world, with important offices in many key cities. It helps a wide range of clients, including large companies, governments, and individual investors.

Being so global helps JPMorgan Chase to earn money in different ways. It also gives the bank a good understanding of local markets, laws, and what customers want. This allows it to adjust its products and services to fit the specific needs of each area.

Key Markets and Operational Hubs

JPMorgan Chase is based in New York City, a key center for finance around the world. From there, its influence spreads through a network of important locations worldwide. These hubs are often in major cities like London, Hong Kong, and Tokyo. They help the company run its operations smoothly in these areas, making cross-border transactions easy and offering local financial solutions.

Each hub has a team of experts who know the local markets, rules, and what customers want. This helps JPMorgan Chase meet the special needs of its clients in different regions. This system, decentralized but connected, allows the company to use its global skills while providing customized financial services that fit local demands.

JPMorgan Chase's worldwide reach not only makes it stronger in well-known markets but also helps it grow in new economies, including health care. The company is always looking for chances to expand its business into new markets, keeping it at the forefront of the global financial services industry.

Strategies for International Expansion

International expansion is a key part of JPMorgan Chase's growth plan. It helps the company earn money from different sources, reach new customers, and strengthen its status as a global financial leader. The company's high market capitalization shows how well its global strategy works and reflects investors' trust in its ability to manage the challenges of international markets and grow sustainably.

JPMorgan Chase uses a mix of methods for international growth. It focuses on growing its existing business as well as making smart acquisitions and forming partnerships. This way, the company can use its strengths while also getting local market knowledge, strong customer connections, and necessary approvals from regulation through these alliances.

A big part of its strategy is understanding local market conditions, rules, and what customers want. JPMorgan Chase puts emphasis on building solid relationships with local regulators, decision-makers, and community leaders. This ensures its operations match national goals and help grow the economy in the areas where it works.

Financial Performance Overview

JPMorgan Chase shows strong financial health. This comes from its strong business model, different ways to make money, and careful management of risks. The company has done well financially, even during tough times, which helps build trust with investors. This solidifies its role as a top player in the global financial services field.

Looking closely at its financial performance gives us insight into its plans, profit, and growth chances. It also shows how well the company creates value for shareholders by making smart investments, running things well, and staying focused on offering good services to its clients.

Annual Revenue and Profit Trends

JPMorgan Chase's financial performance over the past few years has been marked by consistently strong annual revenue and profit trends, demonstrating the resilience of its business model and its ability to generate sustainable financial returns. The bank has successfully navigated fluctuating interest rates, evolving regulatory landscapes, and periods of economic uncertainty to deliver impressive financial results, solidifying its position as a pillar of strength within the financial services industry.

|

Fiscal Year |

Revenue (USD Billion) |

Net Income (USD Billion) |

|

2020 |

119.54 |

29.13 |

|

2021 |

125.33 |

48.33 |

|

2022 |

128.70 |

37.68 |

These figures highlight the bank's ability to generate consistent revenue growth while adapting to changing market conditions. JPMorgan Chase's strong financial performance can be attributed to several factors, including its diversified business model, global reach, technological investments, and disciplined risk management practices.

Analysis of Recent Financial Statements

A closer look at JPMorgan Chase's recent financial reports shows important details about how the company runs its operations, makes profits, and carries out its plans. These reports give a clear picture of what they own, what they owe, their equity, revenue, and expenses. This information helps analysts and investors look at the bank's financial strength and chances for growth.

One important number that shows how much investors trust the bank's future is its stock price. JPMorgan Chase's stock has done better than the overall market for a long time. This shows the company can generate value for its shareholders through smart choices and working well, along with a focus on strong financial returns.

The bank is dedicated to being open and having good management practices. This is clear in its complete financial reports that follow top accounting rules. This focus on financial honesty builds trust with investors, customers, and regulators, helping to establish JPMorgan Chase as a strong and dependable financial institution.

Corporate Social Responsibility (CSR) Initiatives

JPMorgan Chase cares about its social responsibility. The company aligns its efforts with sustainability and community welfare. It takes part in giving back to society by focusing on education, helping the environment, and promoting economic growth. JPMorgan Chase shows it wants to make a good difference, not just in financial services. The company works with partners and runs programs that help the community. They believe in taking responsibility and want to support society while being a top global financial institution.

Environmental Sustainability Efforts

Recognizing the need to tackle climate change quickly, JPMorgan Chase has made big promises for environmental sustainability. The company knows its importance in supporting a low-carbon economy. It has set high goals to cut down its carbon footprint, encourage sustainable finance, and help clients in their own sustainability efforts.

JPMorgan Chase has rolled out many green initiatives in its operations. These include using less energy, switching to renewable energy, reducing waste, and advocating for sustainable practices in its supply chain. The company is also leading the way in sustainable finance. It helps fund projects in renewable energy, green bonds, and other efforts that promote a more sustainable future.

By adding environmental sustainability into its main business plans, JPMorgan Chase hopes to create lasting value for its shareholders, clients, employees, and the communities it serves. This shows its dedication to a healthier planet and a more sustainable future.

Community Development and Philanthropy

JPMorgan Chase is dedicated to building strong and inclusive communities. They believe that healthy communities are key to economic growth and happiness. That's why they invest a lot in various programs. These programs help create job opportunities, make housing more affordable, and ensure good financial health.

A big part of their efforts is to improve neighborhoods that need support. They encourage small businesses and help create jobs for local people. They work closely with community groups, nonprofits, and local leaders. Together, they find and fix important social and economic issues using their resources and know-how.

In addition, JPMorgan Chase takes part in many charitable efforts. They support education, healthcare, the arts, and disaster relief. By providing grants, encouraging employee volunteering, and forming partnerships, they aim to make a positive difference. Their goal is to empower people and strengthen communities all over the world.

Regulatory Challenges and Legal Affairs

JPMorgan Chase works in the complicated and closely watched financial services industry. It faces challenges from changing rules and has to manage legal and compliance risks. The company has dealt with fines and more focused attention because of issues like anti-money laundering, mortgage lending practices, and market cheating.

JPMorgan Chase understands that keeping high ethical standards is very important. It has put strong compliance programs in place and spent a lot to improve its control systems. The company knows that gaining public trust is crucial. Therefore, it aims to learn from past mistakes, improve its compliance systems, and meet the expectations from regulators.

Overview of Major Legal Settlements

In recent years, JPMorgan Chase has made large legal settlements with government agencies and private groups, reflecting the challenges and changes in the rules of the financial services industry after incurring significant losses. The settlements have dealt with issues like mortgage-backed securities, claims about breaking sanction laws, and were also accompanied by various press release announcements.

The company says it has worked hard to improve its compliance programs, internal controls, and risk management to stop problems in the future. They recognize the need to stay alert in spotting and managing legal and regulatory risks around the world.

JPMorgan Chase's legal settlements remind us how important it is to have strict compliance systems and a culture that values ethical behavior and following the rules. The company keeps investing in making its compliance programs stronger, training employees, and building a culture of compliance. This helps them handle the challenges of regulations and keep the trust of the people who have an interest in their work.

Impact of Regulatory Changes on Operations

The financial services industry often faces many changes in rules. These changes aim to make the financial system safer, protect consumers, and stop financial wrongdoings. JPMorgan Chase, like other big banks, needs to adjust its operations to follow new banking rules and meet the demands of regulators.

For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States has greatly affected how JPMorgan Chase operates. This includes changes in capital adequacy, risk management, and consumer protection. The bank has spent a lot of money to improve its compliance system, boost its risk management skills, and adjust its business practices to meet these new rules.

Even though following new regulations can be tough and cost a lot of money, JPMorgan Chase knows that having a stable and well-regulated financial industry is key for economic growth and success. The company aims to work closely with regulators, partner with other banks, and promote a culture of compliance. This way, they can deal with the changes in regulations effectively.

Competitive Landscape and Market Position

The financial services industry around the world is very competitive. Many well-known banks and new fintech companies are all trying to gain a share of the market. JPMorgan Chase is part of this tough environment. It competes with global banks, local banks, special financial firms, and tech companies that are now offering financial services.

Even with all this competition, JPMorgan Chase has stayed a leader in the industry. It uses its size, strength, and technology to stay ahead. The company needs to keep finding new ideas and changing its business plans. It also has to use its funds wisely to stay strong and give good value to the people involved.

Key Competitors and Industry Ranking

JPMorgan Chase has strong competition from some of the world's biggest banks. Its main rivals include Bank of America, Citigroup, and Wells Fargo in the United States. It also competes with major international banks like HSBC, Barclays, and BNP Paribas. All of these banks fight for business in investment banking, consumer banking, wealth management, and global markets.

Many industry rankings, such as those from Forbes and Fortune, regularly list JPMorgan Chase as one of the top banks, a fact that can be verified through historical records at the Wayback Machine. This shows its size, profits, and good reputation. The rankings show how the company stands out in important markets and how it often does better than others in making money.

In addition to these big competitors, JPMorgan Chase also faces challenges from specialized banks like Morgan Stanley and Goldman Sachs. It must also consider smaller regional banks that focus on specific areas in financial services. The company knows it must adapt and innovate to keep its strong position in this ever-changing market.

Strategic Moves to Stay Ahead

In a fast-changing financial world, JPMorgan Chase knows it cannot stay still. The company keeps its edge by being active in innovation, making smart purchases, and always improving its strengths.

JPMorgan Chase sees the important role of technology and has invested a lot in new ideas, especially in fintech, artificial intelligence, and data analytics. The company understands that using the latest technologies is key to making operations better, improving customer experiences, and creating new products and services that meet client needs.

In addition, JPMorgan Chase grows its reach and skills by carefully choosing to buy smaller banks and fintech startups. These buys help the company access new technologies, explore different markets, and attract new talent. This strategy boosts its competitive edge and sets up for future growth.

Employee Culture and Diversity Initiatives

JPMorgan Chase knows that a diverse and inclusive workforce is key for promoting innovation, improving performance, and serving clients around the world well. The company aims to create a workplace where each employee feels valued, respected, and able to share their unique skills.

With its diversity, equity, and inclusion programs, JPMorgan Chase seeks to attract, develop, and keep a workforce that mirrors the communities it serves. It also wants to create a culture that welcomes different views and backgrounds. The company believes that having a diverse workforce improves decision-making, boosts innovation, and strengthens financial results.

Diversity, Equity, and Inclusion Programs

JPMorgan Chase has started many diversity programs. These programs help to improve fairness and inclusion in the company. They focus on getting more women, people of color, LGBTQ+ individuals, veterans, and people with disabilities into leadership roles and other parts of the business.

The company aims to go beyond just hiring and make sure every employee has equal chances to grow, get promoted, and receive fair pay. JPMorgan Chase knows that creating a fully inclusive workplace needs ongoing work. This includes tackling hidden bias and encouraging support among employees so that everyone feels valued and can contribute.

JPMorgan Chase thinks that diversity, equity, and inclusion are very important. It is not just about corporate responsibility. It is a key strategy. The company knows that having a varied and inclusive team is necessary to attract the best talent, encourage new ideas, and ensure future success.

Employee Benefits and Work Environment

JPMorgan Chase wants to create a positive and rewarding place to work for its employees. The company knows that the well-being and growth of its staff are important for its success. They offer a wide range of benefits to support their employees' physical, financial, and emotional health.

These benefits include good salaries and bonuses, health insurance plans, retirement savings, paid time off, parental leave, help with tuition, and many employee resource groups to build a sense of community. JPMorgan Chase also encourages learning and growth. They give employees chances to improve their skills, face new challenges, and grow in their careers.

JPMorgan Chase knows that having a supportive workplace is key to bringing in and keeping talented people. This helps encourage teamwork and spark innovation. The company works hard to build a culture of respect and excellence, where employees feel appreciated and can share their unique talents and ideas.

Investment Strategies and Financial Products

JPMorgan Chase provides many different investment options and financial products. These are made to fit the needs of both regular and big clients. The company uses its strong knowledge of the market, good research skills, and global presence to create investment plans that match specific goals, risk levels, and timeframes.

Clients may want to keep their money safe, earn income, or grow their wealth over time. The investment team at JPMorgan Chase helps them build portfolios that meet their goals. They offer access to many types of investments, regions around the world, and different styles of investment.

Retail and Institutional Offerings

JPMorgan Chase offers a wide range of financial products for individual investors, families, and small businesses. They provide everything from basic banking services like checking and savings accounts to more advanced investment options such as mutual funds, ETFs, and annuities. The company also has financial advisors who give personal advice. They help people plan for retirement, save for college, and reach their financial goals.

For bigger clients like pension funds, endowments, insurance companies, and corporations, JPMorgan Chase offers specialized investment management services and securities trading. They use their expert research, advanced trading tools, and skills in complex financial markets. This helps institutional clients manage risks, improve returns, and meet their investment goals.

JPMorgan Chase is also focusing on sustainable and impact investing strategies. They are doing this for both retail and institutional offerings. This shows that they know investors want to invest in ways that are good for the environment and society. Their commitment to sustainable investing shows they care about responsible practices in financial markets.

Innovation in Asset Management

JPMorgan Chase is changing how they manage assets. They use the latest technology and data analysis to improve investment results. The company applies machine learning and predictive models to boost portfolio performance and manage risk. Their strong focus on innovation means clients get customized solutions based on the newest trends in financial services. By blending their expert knowledge with technology, JPMorgan Chase aims to lead in asset management. They work hard to protect and grow client portfolios using smart and modern strategies.

Strategic Acquisitions and Partnerships

JPMorgan Chase works smartly in acquisitions and partnerships. They use their skill in financial services to help them grow. By forming partnerships, JPMorgan Chase can improve its work in investment banking and asset management. Their careful choices about buying other companies help them to be strong in the market. This gives them a mix of services and keeps them important in the fast-changing financial markets. By teaming up with important players, JPMorgan Chase stays a leader in global finance.

Recent Acquisitions and Their Impact

JPMorgan Chase is focused on growth. They have made important recent purchases that have affected the financial services sector. By working with big names in the industry, like Morgan Stanley and Goldman Sachs, the company has strengthened its role in investment banking. These purchases have not only increased JPMorgan Chase's market capitalization but also improved what they offer in asset management and commercial banking. The effects of these smart choices can be seen in New York City and around the world, making JPMorgan Chase a major player in the changing financial markets.

Partnership Models and Collaborative Efforts

JPMorgan Chase uses smart partnerships and teamwork to grow its presence in financial services around the world. By working with important players in the industry, the company strengthens its role as a leader in investment banking and asset management. These partnerships allow JPMorgan Chase to reach new markets and use new technologies. This helps them offer the latest solutions to their clients. Through joint projects and shared investment chances, they create more value for everyone involved while promoting steady growth in a tough market. Teaming up smartly is a key part of JPMorgan Chase's success in the changing finance world.

Challenges and Opportunities Ahead

Navigating the changing world of financial services brings both challenges and chances for JPMorgan Chase. As digital currency and new markets grow, making smart decisions is very important. Adapting to life after the pandemic while keeping clients successful will be a top priority. Using new ideas in asset management and responding to changes in rules will help drive future growth. As the industry evolves, leaders need to pay attention to market trends. By preparing for changes, JPMorgan Chase can become a leader in the global financial market. Managing risks and taking chances will be crucial for meeting its growth goals.

Emerging Markets and Digital Currency

The growth in emerging markets gives JPMorgan Chase many chances to succeed. As a key name in financial services, they are good at dealing with these changing markets. They are also following digital currency trends, especially in places like Hong Kong and the United Kingdom. This helps them strengthen their influence worldwide. By using their skills in investment banking and asset management, they can take advantage of the changing digital scene. The efforts of JPMorgan Chase in these markets show they care about being innovative and staying ahead in the fast-changing world of finance.

Adapting to a Post-Pandemic World

As businesses around the world recover from the pandemic, JPMorgan Chase is making changes to fit the new situation. The company is using its strong financial services skills to adjust how it operates and meet changing customer needs. JPMorgan Chase is paying close attention to market trends and changes. This helps them improve their strategies for being strong and innovative. In this new world, it is essential to be flexible and forward-thinking, which are key beliefs at JPMorgan Chase. By using its strengths in investment banking and asset management, JPMorgan Chase is ready to lead in this changed business landscape.

Leadership Insights and Management Philosophy

Jamie Dimon's leadership at JPMorgan Chase is a high standard in the financial services world. As the Chief Executive Officer, he has a clear vision and focuses on new ideas. His goal is to help the company grow and do well over time. He cares about creating long-term value and managing risks wisely. This is why JPMorgan is one of the biggest and most trusted banks in the world. Other leaders, like the Board of Directors and the Chief Financial Officer, support this way of thinking. They work together to make JPMorgan powerful in the tough world of global finance.

Jamie Dimon's Approach to Leadership

Jamie Dimon, the CEO of JPMorgan Chase, shows great leadership. His smart strategies and deep dedication to doing well have taken the company to new heights in financial services. Dimon believes in creating a culture of fresh ideas, honesty, and inclusion. He focuses on developing talent and values different viewpoints, which helps ensure growth and strength in the company. His clear and strong decision-making, along with a focus on creating long-term value, inspires all employees. Dimon’s caring style and commitment to always getting better have made JPMorgan Chase known as a top name in finance.

Executives' Perspectives on Industry Trends

Executives at JPMorgan Chase have valuable views on trends in the industry. This helps them navigate the always-changing financial services world. They focus on innovation and solutions that put clients first. These leaders keep an eye on market changes and new technologies to make smart decisions. With their skills in investment banking and asset management, they stay ahead and make JPMorgan Chase a leader in the market. They work to adapt quickly to changes in rules and what customers want. This way, they set standards in the industry and shape the company's future. Their forward-thinking approach shows JPMorgan Chase's dedication to being excellent and growing over time.

Client Success Stories and Testimonials

Client success stories and testimonials show how JPMorgan Chase's financial services really make a difference. These stories illustrate how the company’s new ideas have helped both businesses and people. Clients highlight how JPMorgan Chase assists with complex investment options and secured commercial credit. They often express trust and confidence in the company’s skills. These testimonials not only show that JPMorgan Chase cares about client satisfaction but also prove the real results clients get by working with them. These accounts help establish the company as a leader in financial services, setting it apart from others.

Case Studies of Significant Achievements

One important example of JPMorgan Chase's success is its growth in new markets while also being strong in digital currency. The company used its skills in financial services, especially investment banking and asset management, to grow in places like Hong Kong and the United Kingdom. This strategy increased its market capitalization and made it one of the biggest banks in the world. Also, its new ways to handle digital currency transactions have set high standards in the industry. This shows how JPMorgan Chase can adapt to changing financial markets.

Feedback from Long-term Clients

Long-term clients of JPMorgan Chase often share positive experiences about the company. They praise the high-quality service and reliability they receive. Clients mention the personal attention from their relationship managers. They also enjoy the smooth experience when using the many financial services provided. This feedback shows that JPMorgan Chase is dedicated to building trust and lasting relationships. Furthermore, clients value the creative solutions made for their specific needs. This proves that JPMorgan Chase works hard to exceed expectations and provide value for lasting partnerships.

Future Outlook and Growth Projections

The future looks bright for JPMorgan Chase Company. There are strong signs of growth ahead. As a major player in financial services, JPMorgan Chase is ready to take advantage of new markets and digital currency trends. The company is also dedicated to increasing technology. This will likely make its position in the market even stronger. By focusing on new ideas and being flexible, JPMorgan Chase can handle challenges well. It will also take advantage of chances in the changing world of finance. With a hands-on approach, the company is set to grow and succeed in the years to come.

Predictions for the Next Decade

As technology changes the world of financial services, JPMorgan Chase is ready to take the lead in the next ten years. The company focuses on innovation and going digital. Because of this, it is expected to make its investment banking and asset management services even better. The rise of new markets and the use of digital currency are also expected to boost the company's growth. Using its skills and strong market position, JPMorgan Chase will likely strengthen its role as a major player in the global financial markets. It will set new standards for the industry.

Plans for Technological Advancements

JPMorgan Chase is ready to change its tech landscape with new ideas. The company wants to improve customer service and work more efficiently using modern solutions in financial services. By using artificial intelligence and machine learning, JPMorgan Chase aims to stay on top in the digital world. They are also concentrating on data analysis and cybersecurity to protect against online threats. Furthermore, by investing in blockchain technology and looking into digital currency, JPMorgan Chase is leading the way in tech progress in finance. Keep an eye out for exciting updates in technology at JPMorgan Chase.

Conclusion

JPMorgan Chase is a leader in the financial services industry. They face challenges, but they keep coming up with new and creative ideas. The company plays a major role in investment banking and asset management. What makes them stand out is their dedication to helping the community. Looking ahead, it is important for them to adapt to new markets and digital currencies. Under the strong leadership of Jamie Dimon, the company cares about its clients’ success. This puts JPMorgan Chase in a good place for future growth. As they change to meet industry needs, their past deals and partnerships will help guide their way forward.

Frequently Asked Questions

What Makes JPMorgan Chase Unique in the Banking Industry?

JPMorgan Chase is known for its different business areas like CCB, CIB, CB, and AWM. It stands out because of its strong CSR efforts. The company also grows through smart acquisitions. Additionally, it adapts well to new markets and the challenges of digital currency.

How Has JPMorgan Chase Adapted to Digital Banking Trends?

JPMorgan Chase is focused on keeping up with digital banking changes. They use new technologies and easy-to-use platforms. Their mobile banking apps and strong cybersecurity help offer a smooth experience for customers, especially with products that carry the JPMorganChase name. They know it's important to adapt to what customers want.

What Are the Key Factors Driving JPMorgan Chase's Success?

JPMorgan Chase is successful because it uses new ideas in asset management. It makes smart choices when buying other companies and works with partners. They face challenges, like dealing with new markets and digital currencies, which helps them grow. Leadership insights, happy clients, and plans for the future are also very important.

How Does JPMorgan Chase Contribute to Sustainability and CSR?

JPMorgan Chase helps the community by investing in it and sticking to honest practices. Their CSR projects emphasize caring for the environment and making a social difference. They aim to meet worldwide goals. By boosting economic growth and assisting local areas, the company shows it cares about sustainable ways to do business.

What Are the Career Opportunities at JPMorgan Chase?

Explore different jobs at JPMorgan Chase. You can work in areas like consumer banking and asset management. Discover roles in corporate finance, technology, and others. Find your way to success with a top company in the financial field.

About databahn

Established in 2015, databahn is an account intelligence company headquartered in Nashua, New Hampshire. The research team specializes in delivering comprehensive and up-to-date insights on Fortune 1000 and Global 2000 companies. databahn offers a range of information services, including deep dive company profiles, financial insights, news updates, competitive analysis, org charts and accurate contact information. databahn's account intelligence is meticulously curated, enabling businesses to make informed decisions, identify sales opportunities, and gain a competitive edge. With the focus on accuracy, completeness, and timeliness, databahn serves as a valuable resource for sales and marketing professionals and other industries that require reliable and actionable insights on large & complex enterprise companies.