Starbucks Org Chart & Sales Intelligence Blog

Starbucks Corporation

2401 Utah Avenue South

Seattle, WA 98134

United States

Main Phone: (206) 447-1575

Website: http://www.starbucks.com

Sector: Consumer Cyclical

Industry: Restaurants

Full-Time Employees: 346,000

Starbucks Org Chart Blog Highlights

Starbucks Corporation (NASDAQ: SBUX) is ranked #114 on the 2020 Fortune 500 list

- Starbucks to Transform U.S. Store Portfolio by Building on the Strength of Digital Customer Relationships and the Convenience of the Starbucks App

- Q3 90-day active members increased 25% over Q2 to 9.9 million, representing 9% growth over the prior year

- Starbucks realigned operating segment reporting structure to better reflect the cumulative effect of streamlining efforts

Starbucks Social Media properties

Facebook: https://www.facebook.com/Starbucks/

Instagram: https://www.instagram.com/starbucks/

LinkedIn: https://www.linkedin.com/company/starbucks/

Twitter: https://twitter.com/starbucks/

YouTube: https://www.youtube.com/starbucks

Starbucks Earnings Call Highlights

The latest earnings call took place on July 28, 2020

Executives In Attendance

- Durga Doraisamy – Vice President-Investor Relations

- Kevin Johnson – President and Chief Executive Officer

- Pat Grismer – Chief Financial Officer

- Roz Brewer – Chief Operating Officer and Group President Americas

Analysts in Attendance

- Jeffrey Bernstein – Barclays

- Sara Senatore – Bernstein

- David Tarantino – Baird

- John Glass – Morgan Stanley

- Sharon Zackfia – William Blair

- John Ivankoe – J.P. Morgan

- Andrew Charles – Cowen & Company

- Matt DiFrisco – Guggenheim

- Brian Bittner – Oppenheimer

- Jon Tower – Wells Fargo

- Chris O’Cull – Stifel

- Dennis Geiger – UBS

Starbucks exited the quarter with 96% of stores open, up from 44% at the beginning of the quarter. With health and well-being top of mind, Starbucks monitored trends and quickly adapted to support partners and serve customers safely and responsibly.

In addition, with national coverage in the U.S., Starbucks Delivers transactions tripled in Q3 from Q2 levels, with the highest volume in the late morning and mid-day. All of this indicates that customers are adapting their routines, and Starbucks is well-positioned to drive further recovery by simply increasing throughput and enhancing those safe, familiar and convenient experiences customers desire.As digital adoption accelerates in China, Starbucks continues to innovate in ways that deepen customer relationships and extend the reach of the Starbucks experience across a variety of digital platforms and ecosystems. In May, Starbucks launched a new WeChat Mini program with new functionality for WeChat users, including Starbucks Delivers. And in June, Starbucks enhanced the Starbucks Rewards program, introducing a multi-tier redemption system, similar to what rolled out in the U.S. last year.

Fueled by new digital initiatives, Starbucks has seen strong sequential growth in active rewards members. In fact, the Q3 90-day active members increased 25% over Q2 to 9.9 million, representing 9% growth over the prior year. Starbucks is reminded by the recent resurgence of COVID-19 cases in Beijing, and the corresponding actions taken to mitigate the spread that new normal requires to monitor the situation in every community, rapidly adapt and innovate in ways that continue to bring more customers into stores and increase the frequency of those visits.

Starbucks Earnings Call on July 28, 2020: https://seekingalpha.com/article/4361656-starbucks-sbux-ceo-kevin-johnson-on-q3-2020-results-earnings-call-transcript?part=single

Starbucks Board of Directors

| NAME | TITLE | COMPANY |

| Myron E. Ullman III | Independent Chair | Starbucks |

| Mellody Hobson | Independent Vice Chair | Starbucks |

| Richard E. Allison, Jr. | CEO | Domino’s |

| Rosalind (Roz) G. Brewer | COO and Group President | Starbucks |

| Andrew Campion | COO | Nike |

| Mary N. Dillon | CEO | Ulta Salon, Cosmetics & Fragrance, Inc. |

| Isabel Ge Mahe | VP & Managing Director of Greater China | Apple Inc. |

| Kevin Johnson | President & CEO | Starbucks |

| Jørgen Vig Knudstorp | Executive Chairman | LEGO Brand Group |

| Satya Nadella | CEO and Director | Microsoft Corporation |

| Joshua Cooper Ramo | Co-CEO and Vice Chairman | Kissinger Associates |

| Clara Shih | CEO | Hearsay Systems, Inc. |

| Javier G. Teruel | Retired Vice Chairman | Colgate - Palmolive Company |

Starbucks Annual Report Highlights

Starbucks 2019 Annual Report For Fiscal Year-End September 29, 2019

In the fourth quarter of fiscal 2019, Starbucks realigned operating segment reporting structure to better reflect the cumulative effect of streamlining efforts. Specifically, Starbucks' previous China/Asia Pacific ("CAP") segment and Europe, Middle East, and Africa ("EMEA") segment have been combined into one International segment

Concurrently, results of Siren Retail, a non-reportable operating segment consisting of Starbucks ReserveTM Roastery & Tasting Rooms, certain stores under the Starbucks Reserve brand and Princi operations, which were previously included within Corporate and Other, are now reported within the Americas and International segments based on the geographical location of the operations.

Starbucks has three reportable operating segments: 1) Americas, which is inclusive of the U.S., Canada, and Latin America; 2) International, which is inclusive of China, Japan, Asia Pacific, Europe, Middle East, and Africa; and 3) Channel Development. Non-reportable operating segments such as Evolution Fresh and unallocated corporate expenses are reported within Corporate

and Other. Revenues from reportable operating segments as a percentage of total net revenues for fiscal 2019 were as follows: Americas (69%), International (23%) and Channel Development (8%).

Starbucks Financial Highlights

| Fiscal Year | |

| Fiscal Year Ends | September 29, 2020 |

| Most Recent Quarter | June 28, 2020 |

| Profitability | |

| Profit Margin | 5.56% |

| Operating Margin | 7.81% |

| Management Effectiveness | |

| Return on Assets | 4.70% |

| Return on Equity | N/A |

| Income Statement | |

| Revenue | $24.06 Billion |

| Revenue Per Share | 20.42 |

| Quarterly Revenue Growth | -38.10% |

| Gross Profit | 7.49B |

| EBITDA | 3.37B |

| Net Income Avi to Common | 1.34B |

| Diluted EPS | 1.13 |

| Quarterly Earnings Growth | N/A |

| Balance Sheet | |

| Total Cash | 4.2B |

| Total Cash Per Share | 3.59 |

| Total Debt | 25.79B |

| Total Debt/Equity | N/A |

| Current Ratio | 0.95 |

| Book Value Per Share | -7.38 |

| Cash Flow Statement | |

| Operating Cash Flow | 1.22B |

| Levered Free Cash Flow | -816.61M |

Starbucks Operations

Revenue from company-operated stores accounted for 81% of total net revenues during fiscal 2019. Starbucks' retail objective is to be the leading retailer and brand of coffee and tea in each of the company's target markets by selling the finest quality coffee, tea and related products, as well as complementary food offerings, and by providing each customer with a unique Starbucks Experience. The Starbucks Experience is built upon superior customer service and a seamless digital experience as well as clean and well-maintained stores that reflect the personalities of the communities in which they operate, thereby building a high degree of customer loyalty.

The company's strategy for expanding global retail business is to increase market share, by selectively opening additional stores in new and existing markets, as well as increasing sales in existing stores, to support long-term strategic objectives to maintain Starbucks standing as one of the most recognized and respected brands in the world.

Starbucks Product Supply

Starbucks buys coffee using fixed-price and price-to-be-fixed purchase commitments, depending on market conditions, to secure an adequate supply of quality green coffee. The company also utilizes forward contracts, futures contracts, and collars to hedge "C" price exposure under price-to-be-fixed green coffee contracts and long-term forecasted coffee demand where underlying fixed price and price-to-be-fixed contracts are not yet available. Total purchase commitments, together with existing inventory, are expected to provide an adequate supply of green coffee through fiscal 2020.

Starbucks Competition

The company's primary competitors for coffee beverage sales are specialty coffee shops. Starbucks believes that customers choose among specialty coffee retailers primarily on the basis of product quality, service and convenience, as well as price. The company continues to experience direct competition from large competitors in the quick-service restaurant sector and the ready-to-drink coffee

beverage market, in addition to both well-established and start-up companies in many international markets. Starbucks also competes with restaurants and other specialty retailers for prime retail locations and qualified personnel to operate both new and existing stores.

Starbucks' coffee and tea products sold through Channel Development segment compete directly against specialty coffees and teas sold through grocery stores, warehouse clubs, specialty retailers.

See the Full Starbucks Annual Report

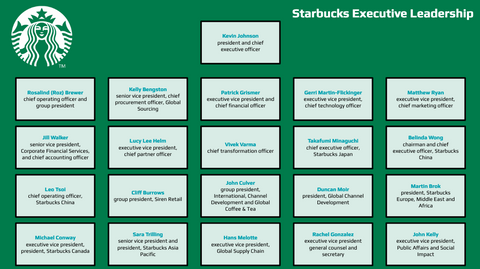

Starbucks Org Charts

| NAME | TITLE |

| Kevin Johnson | President and Chief Executive Officer |

| Duncan Moir | President, Starbucks Emea |

| Belinda Wong | Chairman and Chief Executive Officer, Starbucks China |

| Takafumi Minaguchi | Chief Executive Officer, Starbucks Japan |

| Rosalind (Roz) Brewer | Chief Operating Officer and Group President |

| Leo Tsoi | Chief Operating Officer, Starbucks China |

| John Culver | Group President, International, Channel Development and Global Coffee & Tea |

| Patrick Grismer | Executive Vice President and Chief Financial Officer |

| Michael Conway | Executive Vice President and President, International Licensed Stores |

| Rachel Gonzalez | Executive Vice President General Counsel and Secretary |

| Brady Brewer | Executive Vice President, Chief Marketing Officer |

| Lucy Lee Helm | Executive Vice President, Chief Partner Officer |

| Gerri Martin-Flickinger | Executive Vice President, Chief Technology Officer |

| Hans Melotte | Executive Vice President, Global Channel Development |

| Rossann Williams | Executive Vice President, President U.S. Company-Operated Business and Canada |

| John Kelly | Executive Vice President, Public Affairs and Social Impact |

| Jeff Wile | Senior Vice President and Chief Information Officer, Customer and Retail Technology |

| Lori Digulla | Senior Vice President and General Manager For Starbucks Canada |

| Sara Trilling | Senior Vice President and President, Starbucks Asia Pacific |

| Jon Francis | Senior Vice President, Analytics and Market Research |

| Chris Fallon | Senior Vice President, Business Technology |

| Janet Landers | Senior Vice President, Business Technology |

| Kelly Bengston | Senior Vice President, Chief Procurement Officer, Global Sourcing |

| Jill Walker | Senior Vice President, Corporate Financial Services, and Chief Accounting Officer |

| Zabrina Jenkins | Senior Vice President, Deputy General Counsel |

| Tyson Avery | Senior Vice President, Deputy General Counsel and Chief Ethics and Compliance Officer |

| Rachel Ruggeri | Senior Vice President, Finance, Americas |

| Michelle Burns | Senior Vice President, Global Coffee & Tea |

| George Dowdie | Senior Vice President, Global Food Safety, Quality & Regulatory |

| Luigi Bonini | Senior Vice President, Global Product Innovation |

| Holly May | Senior Vice President, Global Total Rewards & Service Delivery |

| Tom Ferguson | Senior Vice President, International Retail Operations |

| Carl Mount | Senior Vice President, Logistics & U.S. Retail Supply Chain |

| Kyndra Russell | Senior Vice President, Marketing |

| Angela Lis | Senior Vice President, Partner Resources, Global Retail |

| Jen Frisch | Senior Vice President, Partner Resources, U.S. Retail, Licensed Stores and Operations Services |

| Sandra Stark | Senior Vice President, Product |

| Gina Woods | Senior Vice President, Public Affairs |

| Sumitro Ghosh | Senior Vice President, Siren Retail |

| andy Adams | Senior Vice President, Store Development |

| Scott Keller | Senior Vice President, Store Development & Design |

| Mark Ring | Senior Vice President, U.S Licensed Stores and Latin America |

| Shannon Garcia | Senior Vice President, U.S. Operations |

| Denise Nelsen | Senior Vice President, U.S. Operations |

Sales Trigger Events

Starbucks To Allow Access To Supply Chain Data

Aug 2020

Starbucks Corp. is set to begin offering public access to an unprecedented level of data about the bags of coffee it sells, right down to the identity of the farm where it was grown and the roaster where it was prepared.

On the other side of the supply chain, farmers will have near-instant access to sales and market data related to the beans they produce under the newly opened system.

The Seattle-based company says it is using blockchain technology to maintain and serve up the data.

“We have been able to trace every coffee we buy from every farm for almost two decades,” Michelle Burns, senior vice president of coffee, tea and cocoa at Starbucks, said in an interview “That allowed us to have the foundation to now build a user-friendly, consumer-driven tool that certainly provides that trust and confidence to our customers that we know where all of our coffee comes from."

Source

Starbucks Reigns Supreme in Mobile Ordering, but Its App’s UX Is Far From Perfect

August 2020

Despite the app’s consumer popularity and accolades from UX professionals, it’s fumbling on some fundamental design features that could improve the user experience, said John Zimmerman, a professor at Carnegie Mellon’s HCI Institute who teaches courses in user experience design, service design and innovation.

Top 3 issues with the Starbucks App:

1. Difficult Payment Onboarding

2. Complicated Menu Architecture

3. Order Fulfillment Confusion

How they need to fix the issues:

1. Recognize and Infer Payment Patterns Through Machine Learning

2. Improve Voice-Enabled Ordering

3. Create Timed Ordering Options

Source

Life on the edge: A new world for data'

Jan 2020

Starbucks in the US has fitted Microsoft’s Azure Sphere edge computer to its coffee machines. The IoT-enabled machines collect more than a dozen data points for every shot of espresso pulled, from the type of beans used to the coffee’s temperature and water quality, generating over 5MB of data in an eight-hour shift.

According to Microsoft and Starbucks, the connectivity means that coffee shops can not only identify problems with their machines, but Starbucks can also send new coffee recipes directly to machines, replacing the manual task of updating every machine via the USB. Jeff Wile, senior vice-president of retail and core technology services at Starbucks Technology, says: “We have to get to 30,000 stores in nearly 80 markets to update those recipes. The recipe push is a huge part of the cost savings and the justification for doing this.”

Source

Starbucks Looking to Utilize Artificial Intelligence (AI) Technology

Dec 2019

Starbucks is partnering with Microsoft to use data to enhance the customer service experience.

“As an engineering and technology organization, one of the areas we are incredibly excited to be pursuing is using data to continuously improve the experience for our customers and partners,” said Starbucks chief technology officer Gerri Martin-Flickinger.

When a customer uses the Starbucks mobile app, it uses previous orders as data to determine their beverage preferences based on local stores and even offer recommendations. Additionally, the coffeehouse chain is looking to use this same technology for their drive-thru service, allowing customers to view recommendations on a digital menu.

“We’re meeting our customers where they are … using machine learning and artificial intelligence to understand and anticipate their personal preferences,” said senior vice president Jon Francis. “Machine learning also plays a role in how we think about store design, engage with our partners, optimize inventory and create barista schedules. This capability will eventually touch all facets of how we run our business.”

Source

DOWNLOAD THE STARBUCKS TURBO REPORT TO SEE DOZENS MORE SALES TRIGGER EVENTS

More on Starbucks

- Starbucks Contact Info

- Starbucks Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Legal, Supply Chain, Technology, R&D, Manufacturing, etc.

- Starbucks Financial Insights

- Starbucks SWOT Report

- Starbucks Technologies in Use

- Starbucks IT Budgets

- Starbucks Social Media Profiles

- Starbucks Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com