State Farm Org Chart & Sales Intelligence Blog

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

United States

Main Phone: 800-782-8332

Website URL: https://www.statefarm.com/

Fortune 500 Rank: #36

State Farm Fast Facts

Lines of Business

Property and Casualty insurance

Life and Health insurance

Annuities

Mutual Funds

Banking products

State Farm is...

the #1 Auto Insurer1 in the U.S. since 1942.

the #1 Homeowners Insurer1 in the U.S. since 1964.

the #2 largest Life Insurer2 based on policies in force in the U.S. since 2016.

a leading Small Business Insurer3 in U.S. Since 2014.

a leading insurer of watercraft.

ranked number 36th on the 2019 Fortune 500 list of largest companies, based on revenues.

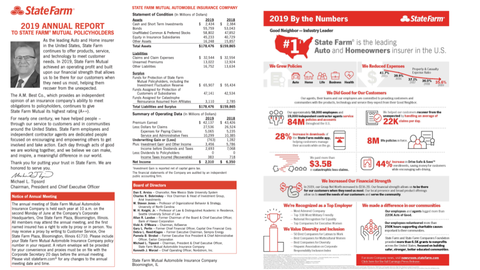

By the Numbers..

State Farm offers about 100 products.

Approximately 19,200 agents.

Approximately 59,000 employees.

State Farm has 84M policies and accounts in force in the U.S. (Financial Reporting & Analysis - U.S. only as of 12/31/2019).

Auto: 44M (includes Small Business).

Fire: 28M (includes Small Business).

Life: 8M.

Small Business: 2.8M.

Health: 891K.

Mutual Funds: 423K.

About 60% of State Farm households have more than one product.

In 2019, Fire and Auto Claims handled about 22,000 claims per day.

State Farm Blog Highlights

State Farm Insurance is ranked #36 on the 2020 Fortune 500 list

- State Farm® to Acquire GAINSCO

- Blockchain Solution Solves State Farm®, USAA Subrogation Challenge

State Farm Social Media properties

Facebook: https://www.facebook.com/statefarm

Instagram: https://www.instagram.com/statefarm/

LinkedIn: https://www.linkedin.com/company/state_farm/

Twitter: https://twitter.com/StateFarm

YouTube: https://www.youtube.com/user/statefarm

State Farm Sales Trigger Events

Blockchain Solution Solves State Farm®, USAA Subrogation Challenge

Jan 2021

In an age of fast-paced technology, large insurance companies need to work together to meet rising customer expectations. It’s important for insurers and financial institutions to continuously invest, innovate and evolve for the future. For State Farm® and USAA, blockchain has provided the answer. Today, State Farm and USAA announced that auto subrogation claims settled between the two companies will be processed using blockchain technology. “We are always looking at ways we can operate more efficiently to benefit our customers," said Robert Yi, chief claim officer at State Farm. “In most cases, this blockchain solution will assist in speeding up subrogation recovery, resulting in an earlier return of the customer's deductible.”

Companies across many industries are using blockchain technology to securely store data and manage transactions. With its unique encryption and security features, blockchain has the potential to affect and transform many industries. “Carrier-to-carrier claims payments will be almost completely automated in the future, saving time and money,” said Sean Burgess, USAA chief claims officer. “Utilizing blockchain technology helps us securely improve and automate a manual process and ultimately gets money back to our members and customers faster.” “We are actively seeking other insurers to join us in this subrogation blockchain solution," Yi said. “The more insurers that embrace secure and efficient technology solutions, like blockchain, the greater the return for all of our insurance customers.”

Source

State Farm® to Acquire GAINSCO

Jan 2021

announced Sept. 17, 2020, that they have entered into an agreement pursuant to which State Farm will acquire GAINSCO for approximately $400 million in cash The transaction is expected to close in early 2021, subject to approval by GAINSCO’s shareholders, the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, obtaining regulatory approvals, and satisfaction of other customary closing conditions. GAINSCO concentrates on the non-standard personal automobile insurance market, specializing in minimum-limits personal auto insurance.

The transaction is the first acquisition of an insurance company by State Farm in its 98-year history. “We believe this acquisition positions both our company and GAINSCO well for future growth,” said Michael Tipsord, State Farm President, Chairman, and CEO. “Because of our competitive value, broad line of products, and exceptional customer service from our employees and 19,200 State Farm independent contractor agents, customers have made us the largest property and casualty insurer for several decades. We are excited for the opportunity State Farm agents will have to serve a market that has historically not been open to them. This will help us further toward our goal of serving more customers in more ways.”

Source

State Farm selected as a marketer of the year.

Dec 2020

State Farm® has been named a 2020 Marketer of the Year by Ad Age. The advertising publication said of the organizations honored, "The 10 brands that comprise Ad Age’s 2020 Marketers of the Year list didn’t just survive the pandemic, they thrived."

And in 2020? What an accomplishment!

“In February, when we refreshed our brand and reintroduced Jake from State Farm, none of us could have imagined what was about to unfold,” said Rand Harbert, Executive Vice President and Chief Agency, Sales and Marketing Officer. “In this unique time, being a good neighbor is more important than ever, and we continue to find new and different ways to tell our story to consumers."

The Ad Age editorial board determines the nominees, so this recognition is especially meaningful because there is no application process in order to be considered. Read the full Ad Age story.

Source

State Farm® and Ford Team Up on Usage-based Insurance

Aug 2020

State Farm® and Ford are excited to announce that they have entered into an agreement to share connected vehicle telematics data for usage-based insurance (UBI) products. State Farm customers with eligible connected Ford vehicles will be able to opt-in to Drive Safe & Save, the voluntary UBI program by State Farm that uses vehicle telematics to match premiums to the number of miles driven and rewards good driving behavior through potential discounts.

“State Farm and Ford have a decades-long history of working together on vehicle and driver safety initiatives. Working with Ford on our usage-based insurance program is a great example of how we will continue to work together to meet our mutual customers’ needs today and into the future,” said Chris Schell, State Farm Senior Vice President Property & Casualty.

“Connected vehicles have the potential to deliver great benefits to Ford customers, including the ability to help lower their car insurance premiums through usage-based insurance,” said Stuart Taylor, Executive Director Enterprise Connectivity, Ford Motor Company. “We’re excited about State Farm’s approach of using Ford’s built-in connectivity to promote safer driving habits and enable opportunities for our mutual customers to save money. This agreement further builds on our strong relationship with State Farm to continue to deliver value for our mutual customers.”

Source

How State Farm Plans to Exit the US Banking Sector

Mar 2020

Financial services giant State Farm plans to exit banking operations, aided by a new tie-up with US Bank. US Bank is to take on State Farm’s deposit and credit card accounts, the two companies announced last week, in a process that will start later this year and run on into 2021.

The groups are also exploring plans to share other product lines such as vehicle loans and business banking services. New State Farm customers will be offered US Bank deposit accounts and co-branded credit cards, the companies said.

State Farm indicated that it wanted to focus on its core insurance business. It is the US’s largest provider of car and home insurance services, with an estimated 84 million policies and accounts. In contrast, it has two million “banking and investment planning services”. State Farm president and CEO Michael Tipsord said last week: “State Farm has been committed to helping people for nearly 98 years. US Bank is an outstanding institution that shares our commitment to strong customer relationships.

Source

State Farm® Announces 2019 Financial Results

Feb 2020

In 2019, State Farm property and casualty insurance companies experienced growth in policies while reporting lower earned premium compared to 2018. The decrease in property-casualty (P-C) earned premium reflects a focus on returning value to customers in the form of lower premiums when appropriate. The State Farm life insurance companies paid out nearly $600 million in dividends to policyholders and ended 2019 with $959 billion in total life insurance in force. As the number one Auto and Homeowners insurer in the U.S. and a leader in individual life insurance, State Farm is committed to serving its policyholders and remains a strong choice for insurance and financial services needs.

"Our focus of putting customers first for nearly 98 years continues to underscore our position as the national leader in protecting people. Each year we help millions of our customers recover from the unexpected and live life confidently with the protection we provide," said Senior Vice President, Treasurer and Chief Financial Officer Jon Farney. "Our financial strength, along with our local presence and broad product offerings have earned us the loyalty of our customers and are the reasons more customers are choosing State Farm. Our agents, their teams and our employees are committed to providing customers and communities with the products and service they expect from their Good Neighbor."

Source

Download the State Farm Insurance Deep-Dive Report to see dozens of additional insightful sales triggers

State Farm Board of Directors

| NAME | TITLE | COMPANY |

| Michael L. Tipsord | Chairman, President and Chief Executive Officer |

State Farm Mutual Automobile Insurance Company

|

| Dan E. Arvizu | Chancellor |

New Mexico State University System

|

| Charles K. Bobrinskoy | Vice Chairman and Head of Investment Group | Ariel Investments |

| W. Steven Jones | Professor of Organizational Behavior and Strategy | University of North Carolina |

| Debra L. Reed-Klages | Former Executive Chairman | Sempra Energy |

| W. H. Knight Jr. | Professor of Law | Seattle University School of Law |

| Allan R. Landon | Former Chairman of the Board and CEO | Bank of Hawaii Corp. |

| Vicki A. O'Meara | Chairman | AdSwerve |

| Gary L. Perlin | Former Chief Financial Officer |

Capital One Financial Corporation

|

| Pamela B. Strobel | Former Executive Vice President and Chief Administrative Officer | Exelon Corporation |

| Kenneth J. Worzel | Chief Operating Officer, | Nordstrom, Inc. |

State Farm Annual Report Highlights

Chairman & CEO's Letter

"As the leading Auto and Home insurer in the United States, State Farm continues to offer products, service, and technology to meet customer needs. In 2019, State Farm Mutual achieved an operating profit and built upon our financial strength that allows us to be there for our customers when they need us most, helping them recover from the unexpected."

"The A.M. Best Co., which provides an independent opinion of an insurance company’s ability to meet obligations to policyholders, continues to give State Farm Mutual its highest rating (A++)."

"For nearly one century, we have helped people – through our service to customers and in communities around the United States. State Farm employees and independent contractor agents are dedicated people focused on encouraging and empowering others to get involved and take action. Each day through acts of good we are working together, and we believe we can make, and inspire, a meaningful difference in our world."

Download the Deep-Dive Report to see additional annual report insight

State Farm Org Charts

Download the State Farm Deep-Dive Report to see organizational charts on key departments including Finance, HR, IT, Supply Chain, etc.

More on State Farm

State Farm Contact InfoState Farm Org charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, HR, Supply Chain, Technology, R&D, Manufacturing, etc.

State Farm Financial Insights

State Farm SWOT Report

State Farm Technologies in Use

State Farm IT Budgets

State Farm Social Media Profiles

State Farm Actionable Sales Trigger Events

About databahn

databahn builds customized deep dive account intelligence reports to help sellers and marketers eliminate costly research time and build pipeline opportunities. databahn focuses on large and complex Fortune 500, Fortune 1000, Global 2000, State Government, and Higher Education organizations. databahn's highly experienced research team is located in beautiful Nashua, New Hampshire. For more information, please email info@databahn.com