JPMorgan Chase Org Chart & Sales Intelligence Blog

JPMorgan Chase & Co.

383 Madison Avenue

New York, NY 10179

United States

Main Phone: (212) 270-6000

Website: https://www.jpmorganchase.com

Industry Sector: Financial Services, Banks—Diversified

Full Time Employees: 288,474

CEO: James Dimon, Chairman & CEO

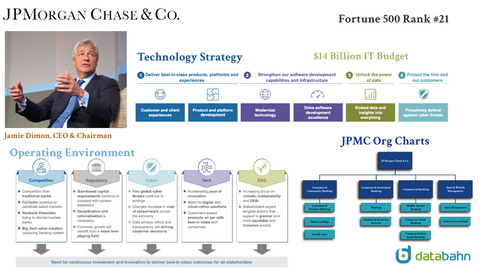

JPMorgan Chase is ranked #21 on the 2022 Fortune 500 list

How would you describe the JPMorgan Chase business segments?

JPMorgan Chase & Co. is a financial holding company incorporated under Delaware law in 1968, is a leading financial services firm based in the U.S., with operations worldwide. JPMorgan Chase had $3.7 trillion in assets and $294.1 billion in stockholders’ equity as of December 31, 2021.

JPMorgan Chase is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, they serve millions of customers, predominantly in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally.

JPMorgan Chase’s activities are organized into four major reportable business segments, as well as a Corporate segment. The consumer business is the Consumer & Community Banking (“CCB”) segment. The wholesale business segments are the Corporate & Investment Bank (“CIB”), Commercial Banking (“CB”), and Asset & Wealth Management (“AWM”).

SEE MORE FINANCIAL INSIGHTS & ANALYSIS

What do the JPMorgan Chase Org Charts look like in 2022?

SEE ALL JPMORGAN CHASE ORG CHARTS

Who are the JPMorgan Chase Executives?

|

James Dimon Chairman and Chief Executive Officer Daniel E. Pinto President and Chief Operating Officer; CEO, Corporate & Investment Bank Ashley Bacon Chief Risk Officer Marc K. Badrichani Head of Global Sales & Research Jeremy Barnum Chief Financial Officer Lori A. Beer Chief Information Officer Mary Callahan Erdoes CEO, Asset & Wealth Management Stacey Friedman General Counsel Takis T. Georgakopoulos Global Head of Wholesale Payments Teresa A. Heitsenrether Global Head of Securities Services Carlos M. Hernandez Executive Chair of Investment & Corporate Banking |

Marianne Lake Co-CEO, Consumer & Community Banking Robin Leopold Head of Human Resources Douglas B. Petno CEO, Commercial Banking Jennifer A. Piepszak Co-CEO, Consumer & Community Banking Troy L. Rohrbaugh Head of Global Markets Peter L. Scher Vice Chairman Sanoke Viswanathan CEO, International Consumer Banking John H. Tribolati Secretary Lou Rauchenberger General Auditor Joseph M. Evangelisti Corporate Communications Mikael Grubb Investor Relations |

SEE 2,500 JPMORGAN CHASE CONTACT IN EXCEL SPREADSHEET

Who sits on the JPMorgan Chase Board of Directors?

|

James Dimon Chairman and Chief Executive Officer JPMorgan Chase & Co. Linda B. Bammann Retired Deputy Head of Risk Management JPMorgan Chase & Co. Stephen B. Burke Retired Chairman and Chief Executive Officer NBCUniversal, LLC Todd A. Combs Investment Officer Berkshire Hathaway Inc.; President and Chief Executive Officer GEICO James S. Crown Chairman and Chief Executive Officer Henry Crown and Company |

Timothy P. Flynn Retired Chairman and Chief Executive Officer KPMG Mellody Hobson Co-CEO and President Ariel Investments, LLC Michael A. Neal Retired Vice Chairman General Electric Company; Retired Chairman and Chief Executive Officer GE Capital Phebe N. Novakovic Chairman and Chief Executive Officer General Dynamics Virginia M. Rometty Retired Executive Chairman and Chief Executive Officer International Business Machines Corporation |

Who is the CEO of JPMorgan Chase?

Jamie Dimon

Chairman and Chief Executive Officer of JPMorgan Chase & Co. Mr. Dimon is an experienced leader in the financial services industry and has extensive international business expertise. As CEO, he is knowledgeable about all aspects of the Firm’s business activities. His work has given him substantial insight into the regulatory process.

Career Highlights

JPMorgan Chase & Co., a financial services company

(merged with Bank One Corporation in July 2004)

- Chairman of the Board (since 2006) and Director

- (since 2004); Chief Executive Officer (since

- 2005)

- President (2004–2018)

- Chief Operating Officer (2004–2005)

- Chairman and Chief Executive Officer at Bank

- One Corporation (2000–2004)

Other Experience

- Member of Board of Deans, Harvard Business

- School

- Director, Catalyst

- Member, Business Roundtable

- Member, Business Council

- Trustee, New York University School of Medicine

Education

• Graduate of Tufts University

• M.B.A., Harvard Business School

SEE MORE JPMC EXECUTIVE PROFILES

Where can I find JPMorgan Chase Annual Report Highlights?

The Firm has global Diversity, Equity & Inclusion centers of excellence, several of which were launched in 2021, that lead the Firm’s strategy in supporting its commitments to create more equity and lasting impact in communities, and strengthen its inclusive culture.

Strategic risks, including the damage to JPMorgan Chase’s competitive standing and results that could occur if management fails to develop and execute effective business strategies; risks associated with the significant and increasing competition that JPMorgan Chase faces; and the potential adverse impacts of climate change on JPMorgan Chase’s business operations, clients and customers.

Strategic Risk Management

Management and oversight

The Operating Committee and the senior leadership of each LOB and Corporate are responsible for managing the Firm’s most significant strategic risks. Strategic risks are overseen by IRM through participation in relevant business reviews, LOB and Corporate senior management meetings, risk and control committees and other relevant governance forums and ongoing discussions. The Board of Directors oversees management’s strategic decisions, and the Board Risk Committee oversees IRM and the Firm’s risk management framework.

JPMC spent $9.941 Billion on Technology, Communications & Equipment in 2021.

Cybersecurity risk

Cybersecurity risk is the risk of the Firm’s exposure to harm or loss resulting from misuse or abuse of technology by malicious actors. Cybersecurity risk is an important and continuously evolving focus for the Firm. Significant resources are devoted to protecting and enhancing the security of computer systems, software, networks, storage devices, and other technology assets.

The Cybersecurity and Technology Control functions are responsible for governance and oversight of the Firm’s Information Security Program. In partnership with the Firm’s LOBs and Corporate, the Cybersecurity and Technology Control organization identifies information security risk issues and oversees programs for the technological protection of the Firm’s information resources including applications, infrastructure as well as confidential and personal information related to the Firm’s employees

and customers.

Source

What are the JPMorgan Chase financial highlights in 2022?

|

Fiscal Year |

|

| Fiscal Year Ends | December 31, 2022 |

| Most Recent Quarter | September 29, 2022 |

|

Profitability |

|

| Profit Margin | 30.74% |

| Operating Margin | 38.12% |

|

Management Effectiveness |

|

| Return on Assets | 0.98% |

| Return on Equity | 12.83% |

|

Income Statement |

|

| Revenue | $120.59 Billion |

| Revenue Per Share | 40.61 |

| Quarterly Revenue Growth | 0.00% |

| Gross Profit | 130.9B |

| Net Income Avi to Common | 35.22B |

| Diluted EPS | 11.85 |

| Quarterly Earnings Growth | -16.70% |

|

Balance Sheet |

|

| Total Cash | $1.43 Trillion |

| Total Cash Per Share | 485.97 |

| Total Debt | 652.29B |

| Book Value Per Share | 87 |

|

Cash Flow Statement |

|

| Operating Cash Flow | 90.99B |

What are the highlights from the JPMorgan Chase Proxy Statement?

We are guided by the firm’s core business principles – exceptional client service, a commitment to integrity, fairness and responsibility, operational excellence and a great team and winning culture. We hold management accountable for developing strategic priorities that will reinforce these principles. In the past year, we added a Sustainable Business Practices tenet to the Firm’s strategic framework, in recognition of the importance of investing in and supporting our communities, integrating sustainability into business and operating decisions, serving a diverse customer base and promoting sound governance.

In furtherance of our commitments to sustainable business practices, the Firm announced a ten-year target to finance and facilitate $1 trillion for climate action, as part of a $2.5 trillion target for sustainable development, and deployed or committed more than $18 billion towards our $30 billion goal to advance racial equity and promote inclusive growth. Through our oversight of the strategic planning process, we also hold management accountable to navigate change and drive innovation while maintaining a strong risk and control environment. In today’s rapidly changing business space, it is critical that we keep pace with innovations in technology and investments in our business offerings. New technologies are changing the way we operate our business, the products and services we offer and even the way we engage with our clients. And the environment in 2021 offered the opportunity to complement our product offerings through acquisitions and investments. Board discussions have focused on what will contribute to the Firm’s future success, including thoughtful investments in technology, acquisitions and the continued identification and retention of top talent.

How are the JPMorgan Chase Executives Compensated?

2021 KEY HIGHLIGHTS

The Firm continued to build upon its strong momentum from prior years amid the continued challenges of COVID-19. In 2021, the Firm reported record revenue of $125.3 billion and net income of $48.3 billion, or $15.36 per share, with ROE of 19% and ROTCE2 of 23%, while returning $28.5 billion of capital to shareholders (including common dividends and net share repurchases). The Firm's results for 2021 included a reduction in the allowance for credit losses of $12.1 billion. We gained market share in our businesses, demonstrated strong expense discipline while continuing to invest into our businesses, continued to achieve high customer satisfaction scores, and maintained a fortress balance sheet.

What does the JPMorgan Chase ESG Strategy look like?

We are leveraging capital and expertise across our company to support a greener future for the planet and advance racial equity. This is a pivotal time for society – government, business and community leaders must move from empty statements and lofty intentions to tangible actions. That is why our company is beginning to implement ambitious targets and commitments to help drive equity and create a more resilient world.

A responsible approach to energy and climate, especially during a time of war, is to immediately help provide energy security around the globe while remaining focused on accelerating the development of affordable, reliable and lower-carbon energy solutions. We have a goal to reduce the carbon intensity of our financing portfolios, starting with oil & gas, electric power and automotive manufacturing, and targeting $1 trillion by 2030 – as part of an overall $2.5 trillion sustainable development target – to advance renewable energy and other innovative technologies. And we are minimizing the environmental impact of our physical operations across thousands of branches, as well as our data centers and corporate offices.

We are also making progress in implementing our $30 billion commitment to help close the racial wealth gap. Financing affordable places for people to live, expanding access to services through local community branches, and supporting Minority Depository Institutions and Community Development Financial Institutions are a few examples of how we’re putting this commitment to work. Because racial equity, like climate, requires a coordinated government response, we are advocating for policies that diversify the appraisal industry, help Americans with no credit file gain access to credit and provide access to affordable small business loans.

_ Jamie Dimon, CEO & Chairman

What are JPMorgan Chase's Strategies for Growth in 2022 and 2023?

1. Market expansion in the U.S.

A few years ago, JPMorgan began launching retail branches in cities and markets in the U.S. where it didn't have a brick-and-mortar presence. It may surprise you to know that up until a few years ago, the largest bank in the U.S. didn't have a single retail branch in major U.S. cities like Boston, Pittsburgh, the District of Columbia, and Philadelphia. Expansion in these cities has already been successful, with JPMorgan quickly building up strong deposit balances at many of its new branches.

2. Wealth management

JPMorgan Chase's asset and wealth management division had a great year in 2020. The unit, which has more than $2.7 trillion in assets under management, generated $14.2 billion in total revenue and delivered a 28% return on equity in 2020. But Piepszak believes the unit, particularly the wealth management segment, is capable of so much more with its existing clients. She noted that JPMorgan serves 50% of households with a net worth between $1 million and $10 million, yet only 5% of those customers invest with JPMorgan.

3. Asset management

Although JPMorgan reports its asset and wealth management in one division, they are two separate business operations. Wealth management focuses on an individual or family's overall financial well-being through services such as retirement planning, tax planning, insurance, and more. Meanwhile, asset management is more focused on clients strictly investing money in stocks, bonds, mutual funds, and other financial instruments to grow wealth, although the lines between wealth and asset management can certainly get blurry at times.

4. Wholesale payments

Piepszak said she sees opportunities in the bank's consumer and wholesale payments businesses. Wholesale payments include merchant services, which offers merchants payment-processing capabilities including fraud and risk management and data and analytics. Through merchant services, businesses of all sizes can accept payments via credit and debit cards and payments in multiple currencies. Wholesale payments also includes treasury services, which help businesses manage their transactions, investments, and information services. Obviously, these are all services for businesses, so branch expansion in the U.S. and global growth will bring in new business clients to the bank that can help further fuel this business line.

5. Consumer payments

A few months ago, JPMorgan acquired several parts of a private company called cxLoyalty, including the company's tech platforms, travel agency, gift card, and points businesses. It seems like a weird time to be buying a travel loyalty credit card program, but the bank obviously believes travel will soon rebound. JPMorgan is one of the largest issuers of credit cards. By owning the travel rewards companies, it will be able to offer existing and new credit card holders special deals related to travel.

6. China

China is beginning to ease some of its trading and banking restrictions as it looks to encourage more foreign investment in the country. In June of last year, the China Securities Regulatory Commission ruled that JPMorgan could fully own and operate a futures subsidiary in China, making it the first completely foreign-owned futures business in the country. JPMorgan is looking to do something similar in China with wealth management as well. Wading further into one of the world's largest economies is sure to provide plenty of growth opportunities for JPMorgan.

Source

SEE MORE INSIGHTS INTO ACTIVE INITIATIVES & PROJECTS AT JPMC

What did Jamie Dimon and Jeremy Barnum say at the latest JPMorgan Chase Earnings Call?

JPMorgan Chase (JPM) Q3 2022 Earnings Call

Oct 14, 2022

JPMC Executives in Attendance

- Jeremy Barnum - Chief Financial Officer

- Jamie Dimon - Chairman and Chief Executive Officer

Comments from Jeremy Barnum, CFO

"The firm reported net income of $9.7 billion, EPS of $3.12 on revenue of $33.5 billion, and delivered an ROTCE of 18%. The only significant item this quarter was discretionary net investment securities losses in corporate of $959 million as a result of repositioning the portfolio by selling U.S. treasuries and mortgages. Our strong results this quarter reflect the resilience of the franchise in a dynamic environment."

"Touching on a few highlights. We had a record third quarter -- we had record third-quarter revenue in Markets of $6.8 billion, we ranked No. 1 in retail deposit share based on FDIC data, and credit is still healthy with net charge-offs remaining low. On Page 2, we have more detail."

"Revenue of $33.5 billion was up $3.1 billion or 10% year on year. Excluding the net investment securities losses, it was up 13%. NII ex-markets was up $5.7 billion or 51%, driven by higher rates. NIR ex-markets was down $3.2 billion or 24%, largely driven by lower IB fees and the securities losses."

Comments from Jamie Dimon, CEO

"And in most areas, we're up in market share, in a few areas, we're not, and of course, that disappoints us. But the earnings power gives us a lot of confidence that we'll get over that 13% in the first quarter. But we always have to keep in mind the volatility and a bunch of other things."

"And/or if we change our outlook, meaning that we think the chance of adverse events are higher, we'll change our reserves. Put in the back of your mind that if unemployment goes to 5% or 6%, you're probably talking about $5 billion or $6 billion over the course of a couple of quarters. Again, easy to handle, not a big deal. It just doesn't affect capital a little bit."

"And the way I'm trying to make it very simple for you. So if you look at the pandemic, we put up $15 billion over two quarters, and then we took it down over three or four after that, OK? And all it did swing all these numbers, and it didn't change that much. I'm trying to give you a number, obviously, this number to be plus or minus several billion. But if unemployment goes to 60%, and that becomes the central kind of case, and then you have possibilities to get better and possibilities gets worse, we would probably add something like $5 billion or $6 billion."

"I mentioned QT as being one of the uncertainties because it's a very large change in the flow of funds around the world, who are the buyers and sellers of sovereign debt. There's a lot of sovereign debt. But I think if you look at the building alone is a bump, it's not going to change what we do or how we do it. And you're going to see bumps like that because all of the things I already mentioned."

Source

JPMorgan Chase Sales Trigger Events

JPMorgan Chase CEO Jamie Dimon: ‘Crypto Tokens Are Like Pet Rocks’

Dec 2022

“I think crypto is a complete side show… And you guys spend too much time on it, and I’ve made my views perfectly clear: crypto tokens are like pet rocks.

“And people hype this stuff up. That doesn’t mean blockchain is not real. That doesn’t mean smart contracts won’t be real or Web 3.0, but cryptocurrencies that don’t do anything, I don’t understand why people spend any time.“

“So you have to separate blockchain, which is real DeFi, which is real ledgers, you know tokens to do something and deliver information, money, ideas, simplify smart contracts. That’s one thing. I’m not a skeptic… I’m a major sceptic on crypto tokens which you call currency like Bitcoin. They are decentralized Ponzi schemes and the notion [that] that’s good for anybody is unbelievable.“

Source

JPMorgan Registers Trademark For Crypto Wallet

November 2022

According to an official document published on Nov. 21, 2022, JPMorgan has officially registered and patented the “J.P. Morgan Wallet” under the United States Patent and Trademark Office (USPTO). This new enrollment will see the legacy bank offer crypto and bitcoin services to its existing pool of customers.

Although the trademark approval came in on Nov. 15, 2022, it was only published today. According to information from Justia, an American website specializing in legal information retrieval, JPMorgan Chase filed for the trademark in July 2020 with the serial 90071872.

Even though CEO Jamie Dimon has been antagonistic towards crypto, the bank has been exploring crypto and blockchain. JPMorgan has joined Fidelity Bank and New York Bank Mellon in offering crypto-related services such as payments and exchanges, as well as other legacy financial institutions.

Source

How JPMorgan Chase allots its $14B IT budget

October 2022

Hybrid cloud infrastructure, digital products and services, predictive analytics, data security, software development and roughly 6,000 apps. Those are some of the larger line items in the $14 billion 2022 IT budget Lori Beer, JPMorgan Chase’s Global CIO, oversees — along with a little R&D spend on metaverse technologies.

“Sometimes people get stuck on the number,” Beer said during the Wall Street Journal’s CIO Network Summit on Sept. 20. “The number is big — it’s $14 billion. But we are a large company that supports a lot of products and services, a lot of which are technology-driven.”

Tech budgets are expected to increase heading into 2023, even as companies cut back spending in other areas to offset the impacts of inflation, economic downturn and geopolitical instability.

Source

J.P. Morgan to Acquire Renovite Technologies

September 2022

J.P. Morgan (NYSE: JPM) is to acquire Renovite Technologies, Inc. (Renovite), a Fremont, California-based cloud-native payments technology company.

The acquisition of Renovite will help J.P. Morgan Payments build its merchant acquiring platform, bolster the firm’s payments modernization strategy and support its journey to the cloud. Upon closing of the transaction, Renovite will become part of J.P. Morgan Payments, which combines corporate treasury services, trade finance, card and merchant services capabilities at the firm, delivering an integrated payments experience to clients across the economy.

“Renovite’s cloud-native merchant acquiring capabilities are already helping us better serve our clients. As the Renovite platform integrates with J.P. Morgan Payments, merchant acquiring clients will be able to accept more methods of payments around the globe to help grow their business.”, said Mike Blandina, Global Head of Payments Technology, J.P. Morgan.

Source

Motive Partners completes sale of Global Shares to JP Morgan

August 2022

Motive Partners ("Motive"), a specialist private equity firm focused on growth equity and buyout investments in software and information services companies that serve the financial services industry ("financial technology"), has received the necessary regulatory approvals, and completes the sale of Global Shares to J.P. Morgan. Motive invested in Global Shares in August 2018, acquiring a ~40% stake in the business.

“We are excited about the potential to partner with corporates globally and help to deliver a range of wealth management solutions to Global Shares’ equity plan participants,” said Michael Camacho, CEO of Wealth Management Solutions, J.P. Morgan.

“Global Shares’ cap table management capabilities represent an important addition to the portfolio of digital solutions we are building for private companies,” said Michael Elanjian, Head of Digital Private Markets, J.P. Morgan.

Source

JPMorgan Chase Elects Alex Gorsky to its Board of Directors

July 2022

Mr. Gorsky serves as Executive Chairman of Johnson & Johnson. He previously served as Chairman and Chief Executive Officer of the company from 2012-2021. Under his leadership, Johnson & Johnson has become one of the world’s largest healthcare companies and one of the foremost innovators in research and development for emerging health technologies. His influence has shaped both the healthcare landscape and the greater business community through his work as a member of the Business Roundtable and on the Business Council. He currently sits on the boards of Apple, Inc., IBM, New York-Presbyterian Hospital, and the Travis Manion Foundation, and serves on the Wharton School of the University of Pennsylvania Board of Advisors.

“Alex Gorsky is one of the most successful and respected leaders in business today, and I have known and admired him for many years, including during our work together on the Business Roundtable. His deep experience in bringing cutting-edge technology to the world’s most urgent and complex healthcare challenges and his long track record of leading innovative and diverse teams around the world will add great value to our company,” said Jamie Dimon, Chairman and CEO of JPMorgan Chase.

Source

SEE DOZENS MORE JPMC SALES TRIGGER EVENTS

More on JPMorgan Chase

JPMorgan Chase Contact Information

JPMorgan Chase Org Charts on Corporate Structure, Executive Leadership, Sales, Marketing, Finance, Procurement, Information Technology, Human Resources, Customer Operations, etc.

JPMorgan Chase Financial Insights

JPMorgan Chase SWOT Report

JPMorgan Chase PESTLE Report

JPMorgan Chase Technographic Profile

JPMorgan Chase IT Budgets

JPMorgan Chase Executive Profiles

JPMorgan Chase Actionable Sales Triggers Events

Would you like to see the JPMorgan Chase Org Charts & Sales Intelligence report? Send us an email at info@databahn.com